⛓️ STATE OF THE CHAINS ⛓️

The @arbitrum ecosystem had a meteoric rise so far

How can you take advantage and find the next 100x?

A megathread on the state of Arbitrum, my top 5 favourite protocols (and my top 5 unlaunched alpha protocols)

🧵👇

The @arbitrum ecosystem had a meteoric rise so far

How can you take advantage and find the next 100x?

A megathread on the state of Arbitrum, my top 5 favourite protocols (and my top 5 unlaunched alpha protocols)

🧵👇

1/32

Introducing a new series of threads where i'll look at the state of different blockchains

In this thread I'll go through

1️⃣ What is Arbitrum

2️⃣ Arbitrum in numbers

3️⃣ Arbitrum development

4️⃣ Top 5 protocols

5️⃣ Top 5 unlaunched alpha protocols

6️⃣ Who to follow for alpha

Introducing a new series of threads where i'll look at the state of different blockchains

In this thread I'll go through

1️⃣ What is Arbitrum

2️⃣ Arbitrum in numbers

3️⃣ Arbitrum development

4️⃣ Top 5 protocols

5️⃣ Top 5 unlaunched alpha protocols

6️⃣ Who to follow for alpha

2/32

1️⃣ What is Arbitrum?

Arbitrum is an Optimistic Rollup Layer 2 scaling solution built on top of Ethereum

It scales Ethereum by executing transactions off-chain and bundling them up and submitting them to Mainnet in a single transaction.

1️⃣ What is Arbitrum?

Arbitrum is an Optimistic Rollup Layer 2 scaling solution built on top of Ethereum

It scales Ethereum by executing transactions off-chain and bundling them up and submitting them to Mainnet in a single transaction.

3/32

This allows for lightning fast transactions at low costs, removing the transaction fee barrier, making it affordable to anyone

A fully decentralized L2 would derive its security from Ethereum.

This allows for lightning fast transactions at low costs, removing the transaction fee barrier, making it affordable to anyone

A fully decentralized L2 would derive its security from Ethereum.

4/32

Arbitrum is the largest Layer 2 blockchain by a good margin, and its ecosystem have seen an extreme growth in the last 6 months with new protocols popping up almost daily

Arbitrum is the largest Layer 2 blockchain by a good margin, and its ecosystem have seen an extreme growth in the last 6 months with new protocols popping up almost daily

5/32

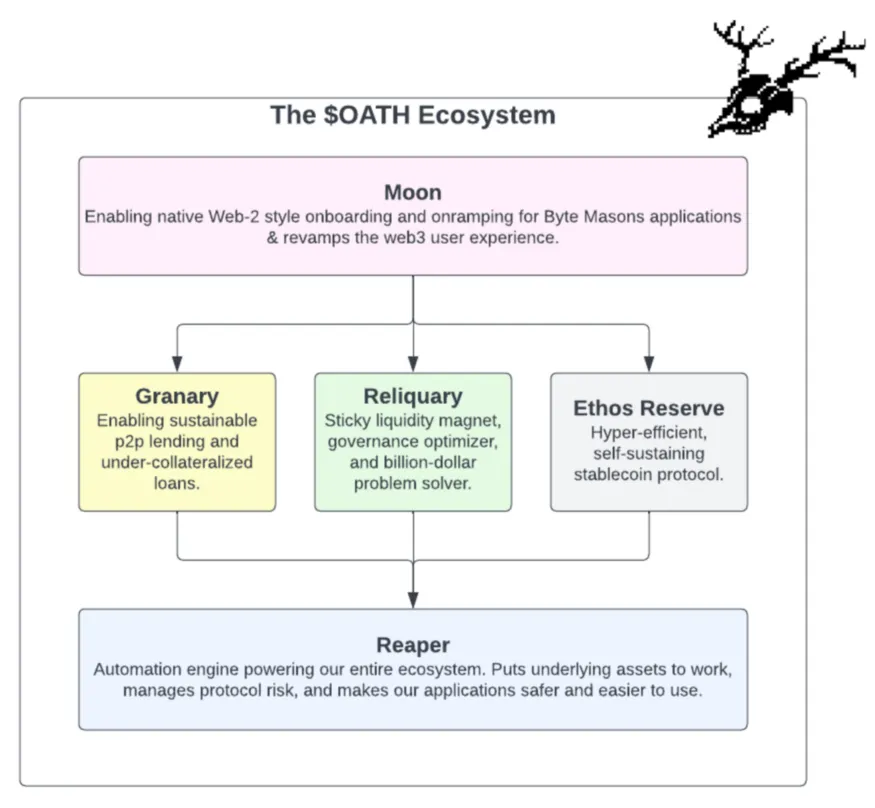

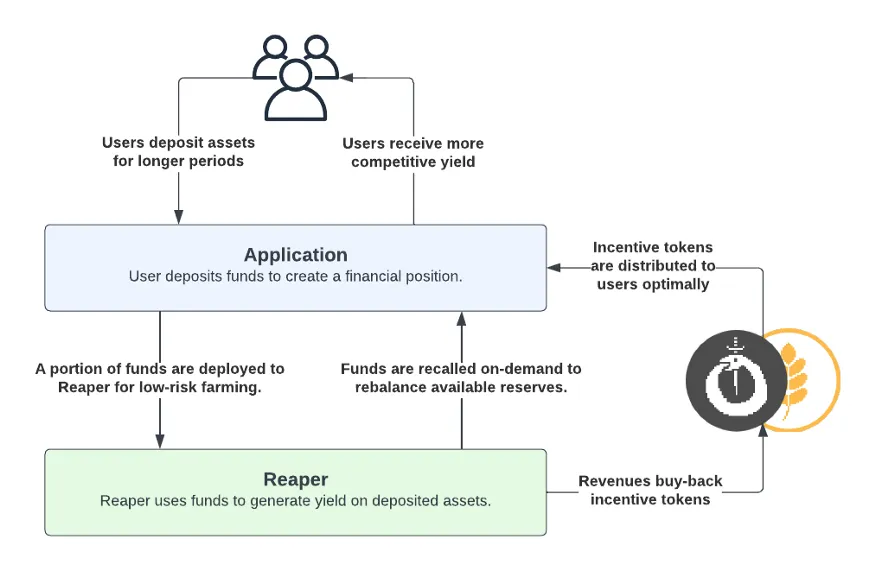

What i'm most excited about in Arbitrum is the innovation and composability seen with protocols building on top of other protocols

The gigabrains litterally cannot stop stacking defi legos on top of eachother

What i'm most excited about in Arbitrum is the innovation and composability seen with protocols building on top of other protocols

The gigabrains litterally cannot stop stacking defi legos on top of eachother

6/32

Another interesting aspect is that we see new and innovative protocols launching directly on an L2, whereas last cycle they always launched on ETH mainnet, and were forked to other chains.

The importance of this should not be underestimated...

Another interesting aspect is that we see new and innovative protocols launching directly on an L2, whereas last cycle they always launched on ETH mainnet, and were forked to other chains.

The importance of this should not be underestimated...

7/32

Imo there is no reason a novel protocol on a L2 shouldn't be valued similarly to competing protocols from ETH Mainnet last bullrun, at peak of next bullrun (if it ever comes..)

There are some LEGIT 100x possibilities on Arbitrum (NFA obviously)

Also.. wen $ARB airdrop

Imo there is no reason a novel protocol on a L2 shouldn't be valued similarly to competing protocols from ETH Mainnet last bullrun, at peak of next bullrun (if it ever comes..)

There are some LEGIT 100x possibilities on Arbitrum (NFA obviously)

Also.. wen $ARB airdrop

8/32

2️⃣ Arbitrum in numbers

✅️ TVL

Arbitrums TVL is currently $1.45 bn according to @DefiLlama making it the largest L2 by quite a big margin

2️⃣ Arbitrum in numbers

✅️ TVL

Arbitrums TVL is currently $1.45 bn according to @DefiLlama making it the largest L2 by quite a big margin

9/32

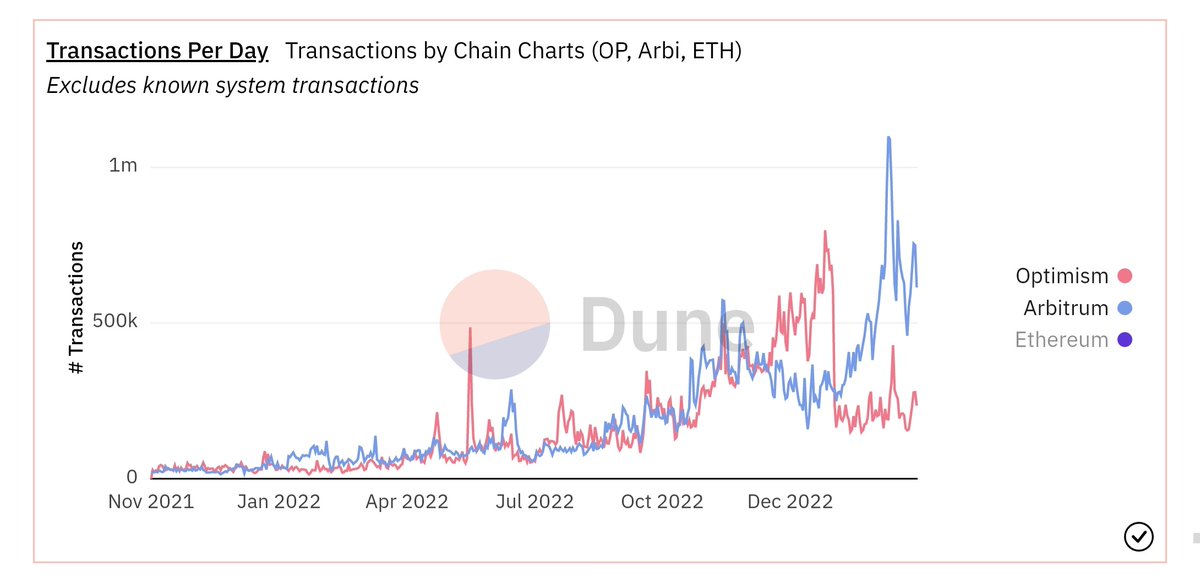

✅️ Daily transactions

The daily transaction count have been rising rapidly, bypassing Optimism and the trend doesnt look like it will stop

Currently it has 615k daily TXs

✅️ Daily transactions

The daily transaction count have been rising rapidly, bypassing Optimism and the trend doesnt look like it will stop

Currently it has 615k daily TXs

10/32

✅️ Volume

Arbitrum have consistently been in the top 3 chains on Volume in the last months

With 24 hour volume at $1.13b and 7day volume at $3.32b

✅️ Volume

Arbitrum have consistently been in the top 3 chains on Volume in the last months

With 24 hour volume at $1.13b and 7day volume at $3.32b

11/32

✅️ Protocols

An ever increasing amount of protocols are deploying to Arbitrum

According to @DefiLlama there are 230 tracked protocols on Arbitrum, soon rivaling L1s from last bullmarket like Fantom and Avalanche

✅️ Protocols

An ever increasing amount of protocols are deploying to Arbitrum

According to @DefiLlama there are 230 tracked protocols on Arbitrum, soon rivaling L1s from last bullmarket like Fantom and Avalanche

12/32

3️⃣ Arbitrum development

✅️ Arbitrum Nitro

Released in September 2022, the long awaited upgrade to Arbitrum came.

Major improvements in increased throughput, lower fees and introducing a next generation rollup architecture.

A 10x performance boost 👀

3️⃣ Arbitrum development

✅️ Arbitrum Nitro

Released in September 2022, the long awaited upgrade to Arbitrum came.

Major improvements in increased throughput, lower fees and introducing a next generation rollup architecture.

A 10x performance boost 👀

13/32

✅️ Decentralization

The goal is to make Arbitrum fully decentralized and for it to derive its security from Ethereum Mainnet

To do this it needs to achieve 3 things

Decentralization of sequencer, validators and the admin or owners of the protocol contracts themselves

✅️ Decentralization

The goal is to make Arbitrum fully decentralized and for it to derive its security from Ethereum Mainnet

To do this it needs to achieve 3 things

Decentralization of sequencer, validators and the admin or owners of the protocol contracts themselves

14/32

Validators (validating the state of Arbitrum) are still permissioned but are run by some of the most trusted companies in crypto

ConsenSys

Ethereum Foundation

L2BEAT

Mycelium

Offchain Labs

P2P

Quicknode

Distributed Ledgers Research Centre (DLRC)

Unit 410

Validators (validating the state of Arbitrum) are still permissioned but are run by some of the most trusted companies in crypto

ConsenSys

Ethereum Foundation

L2BEAT

Mycelium

Offchain Labs

P2P

Quicknode

Distributed Ledgers Research Centre (DLRC)

Unit 410

15/32

Decentralization of L2s is a long and complex process but i'm happy to see Arbitrum working against that goal

Decentralization of L2s is a long and complex process but i'm happy to see Arbitrum working against that goal

16/32

✅️ Stylus

Stylus is a next-gen programming environment upgrade.

It will allow devs to write programs in Rust, C, C++ to run alongside solidity code on Arbitrum

✅️ Stylus

Stylus is a next-gen programming environment upgrade.

It will allow devs to write programs in Rust, C, C++ to run alongside solidity code on Arbitrum

17/32

It will be over an order-of-magnitude faster, slash fees, and be fully interoperable with the Ethereum Virtual Machine.

Arbitrum already have working Fraud Proofs, and with Stylus comes a revolution in EVM compability with EVM+

Wen Stylus? 2023

It will be over an order-of-magnitude faster, slash fees, and be fully interoperable with the Ethereum Virtual Machine.

Arbitrum already have working Fraud Proofs, and with Stylus comes a revolution in EVM compability with EVM+

Wen Stylus? 2023

18/32

4️⃣ Top 5 protocols

Here are 5 protocols i view as Arbitrum blue chips, because of the traction they have gained, or the innovation they bring.

I love betting on gigabrain teams ...NFA

4️⃣ Top 5 protocols

Here are 5 protocols i view as Arbitrum blue chips, because of the traction they have gained, or the innovation they bring.

I love betting on gigabrain teams ...NFA

19/32

✅️ Radiant

$RDNT @RDNTCapital

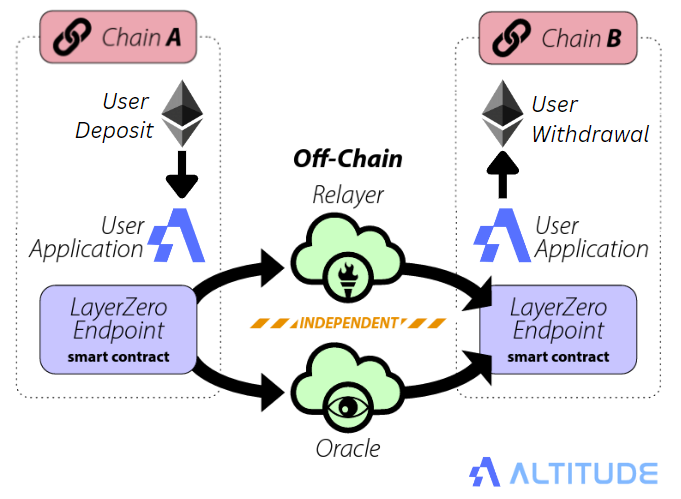

An omnichain moneymarket built on LayerZero tech.

Real yield to stakers

Arbitrums largest lending/borrowing protocol, soon going multichain with v2, which also includes a new defi primitive Dynamic Liquidity

✅️ Radiant

$RDNT @RDNTCapital

An omnichain moneymarket built on LayerZero tech.

Real yield to stakers

Arbitrums largest lending/borrowing protocol, soon going multichain with v2, which also includes a new defi primitive Dynamic Liquidity

https://twitter.com/Slappjakke/status/1615933090756702208

20/32

✅️ GMX

$GMX @GMX_IO

A decentralized perpetual leverage trading exchange (perp dex) with innovative tokenomics.

Based on GLP liquidity pool but will soon introduce synthetic assets.

The godfather of Real Yield, high fees and the main building block of Arbitrum defi

✅️ GMX

$GMX @GMX_IO

A decentralized perpetual leverage trading exchange (perp dex) with innovative tokenomics.

Based on GLP liquidity pool but will soon introduce synthetic assets.

The godfather of Real Yield, high fees and the main building block of Arbitrum defi

https://twitter.com/Slappjakke/status/1598554046062698496

21/32

✅️ Dopex

$DPX $rDPX @dopex_io

An OG decentralized options protocol.

Gigabrain innovators and master shitposters

Innovating with

-Decentralized Options Vaults + AMM

-Their Atlantics products (borrow collateral for capital efficiency)

-Synthetic assets with rDPX v2

✅️ Dopex

$DPX $rDPX @dopex_io

An OG decentralized options protocol.

Gigabrain innovators and master shitposters

Innovating with

-Decentralized Options Vaults + AMM

-Their Atlantics products (borrow collateral for capital efficiency)

-Synthetic assets with rDPX v2

https://twitter.com/Slappjakke/status/1596851952075165696

22/32

✅️ DAO Jones

$JONES @JonesDAO_io

Started off building Options strategies on top of Dopex.

Evolved into boosted LP farms with Metavaults

And Delta Maximal jGLP and real yield jUSDC vaults

This is a bet on innovation and gigabrains

✅️ DAO Jones

$JONES @JonesDAO_io

Started off building Options strategies on top of Dopex.

Evolved into boosted LP farms with Metavaults

And Delta Maximal jGLP and real yield jUSDC vaults

This is a bet on innovation and gigabrains

https://twitter.com/Slappjakke/status/1619681345760006151

23/32

✅️ Magic

$MAGIC @Treasure_DAO

One of the real OG gamefi and metaverse projects on Arbitrum

Creating multiple games and NFT collections, while having the $MAGIC token as the focal point of the whole ecosystem

✅️ Magic

$MAGIC @Treasure_DAO

One of the real OG gamefi and metaverse projects on Arbitrum

Creating multiple games and NFT collections, while having the $MAGIC token as the focal point of the whole ecosystem

https://twitter.com/DeFiMinty/status/1615755226337755136

24/32

5️⃣ Top 5 unlaunched alpha protocols

5 upcoming Arbitrum protocols that i'm very interested in and think have potential to become blue chips in the future

5️⃣ Top 5 unlaunched alpha protocols

5 upcoming Arbitrum protocols that i'm very interested in and think have potential to become blue chips in the future

25/32

✅️ GammaSwap

$GS @GammaSwapLabs

GammaSwap is an Oracle Free Decentralized Platform for Volatility Trading and Commission Free Token Trading

You can go long gamma by borrowing LP tokens to short them to make the LPs Impermanent Loss into your Impermanent Gain

✅️ GammaSwap

$GS @GammaSwapLabs

GammaSwap is an Oracle Free Decentralized Platform for Volatility Trading and Commission Free Token Trading

You can go long gamma by borrowing LP tokens to short them to make the LPs Impermanent Loss into your Impermanent Gain

https://twitter.com/Slappjakke/status/1614644198212505605

26/32

✅️ Smilee Finance

$SMILEE @SmileeFinance

Smilee is building primitives for DVPs (Decentralized Volatility Products)

They are focusing on long/short gamma (volatility) via Real Yield or Impermanent Gain vaults.

Taking a synthetic approach to volatility markets

✅️ Smilee Finance

$SMILEE @SmileeFinance

Smilee is building primitives for DVPs (Decentralized Volatility Products)

They are focusing on long/short gamma (volatility) via Real Yield or Impermanent Gain vaults.

Taking a synthetic approach to volatility markets

https://twitter.com/Slappjakke/status/1615618171398160384

27/32

✅️ Dolomite

@Dolomite_io

A next gen margin trading- and lending protocol on Arbitrum

Dolomite combines the strengths of a DEX and a lending protocol into a highly capital efficient and modular defi protocol

Softlaunched already, thread coming soooon 😉

✅️ Dolomite

@Dolomite_io

A next gen margin trading- and lending protocol on Arbitrum

Dolomite combines the strengths of a DEX and a lending protocol into a highly capital efficient and modular defi protocol

Softlaunched already, thread coming soooon 😉

28/32

✅️ Orbital

$ORB @orbitaldex

An Arbitrum native dex created by the gigabrains behind @dopex_io and @PlutusDAO_io

Options as defi infrastructure and possibility to LP with borrowed assets and no asset price exposure (only risk the IL)

✅️ Orbital

$ORB @orbitaldex

An Arbitrum native dex created by the gigabrains behind @dopex_io and @PlutusDAO_io

Options as defi infrastructure and possibility to LP with borrowed assets and no asset price exposure (only risk the IL)

https://twitter.com/Slappjakke/status/1630172620883673088

29/32

✅️ Tapioca DAO

$TAP @tapioca_dao

Tapioca DAO is a project that is focused on building omni-chain DeFi products, from lending markets to token wrappers.

Tapioca is built on top of Layer Zero technology, allowing them to access most EVM chains with non-EVM coming later

✅️ Tapioca DAO

$TAP @tapioca_dao

Tapioca DAO is a project that is focused on building omni-chain DeFi products, from lending markets to token wrappers.

Tapioca is built on top of Layer Zero technology, allowing them to access most EVM chains with non-EVM coming later

https://twitter.com/kindahangry/status/1586281757711572993

30/32

🚨 Disclaimer

None of this is financial advice, this is purely for educational purposes.

Just because i mention a protocol here does not mean that right now is a good entry or that i hold the asset

🚨 Disclaimer

None of this is financial advice, this is purely for educational purposes.

Just because i mention a protocol here does not mean that right now is a good entry or that i hold the asset

31/32

6️⃣ Who to follow for the Arbitrum alpha

@LouisCooper_

@CryptoKaduna

@ChadCaff

@WinterSoldierxz

@defi_mochi

@Route2FI

@ThorHartvigsen

@Chinchillah_

@0xFlips

@DeFiMinty

@SmallCapScience

@rektdiomedes

@kindahangry

@Louround_

@Slappjakke

@0xTindorr

@TheDeFISaint

@DAdvisoor

6️⃣ Who to follow for the Arbitrum alpha

@LouisCooper_

@CryptoKaduna

@ChadCaff

@WinterSoldierxz

@defi_mochi

@Route2FI

@ThorHartvigsen

@Chinchillah_

@0xFlips

@DeFiMinty

@SmallCapScience

@rektdiomedes

@kindahangry

@Louround_

@Slappjakke

@0xTindorr

@TheDeFISaint

@DAdvisoor

32/32

Thats a wrap

Follow me @Slappjakke for more alpha and more chain deepdives

Comment your favourite Arbitrum protocol below so I can take a look at it

Like and Retweet the first tweet below if you enjoyed this thread so others can see

Thats a wrap

Follow me @Slappjakke for more alpha and more chain deepdives

Comment your favourite Arbitrum protocol below so I can take a look at it

Like and Retweet the first tweet below if you enjoyed this thread so others can see

https://twitter.com/Slappjakke/status/1634931752308441088

• • •

Missing some Tweet in this thread? You can try to

force a refresh