1/ Instadapp just launched Avocado: Blockchain aggregator with a next-gen wallet.

It's the coolest thing I've seen in a long time.

Here's how it works & why it's a big deal: 🥑

It's the coolest thing I've seen in a long time.

Here's how it works & why it's a big deal: 🥑

2/ Avocado revolutionizes how we currently interact with dApps:

1. Go to the dApp website

2. Connect wallet

3. Add/switch to the correct network

4. Prepare a transaction on dApp

5. Approve it on the wallet (hopefully you've got tokens to pay for gas)

No more of this with 🥑

1. Go to the dApp website

2. Connect wallet

3. Add/switch to the correct network

4. Prepare a transaction on dApp

5. Approve it on the wallet (hopefully you've got tokens to pay for gas)

No more of this with 🥑

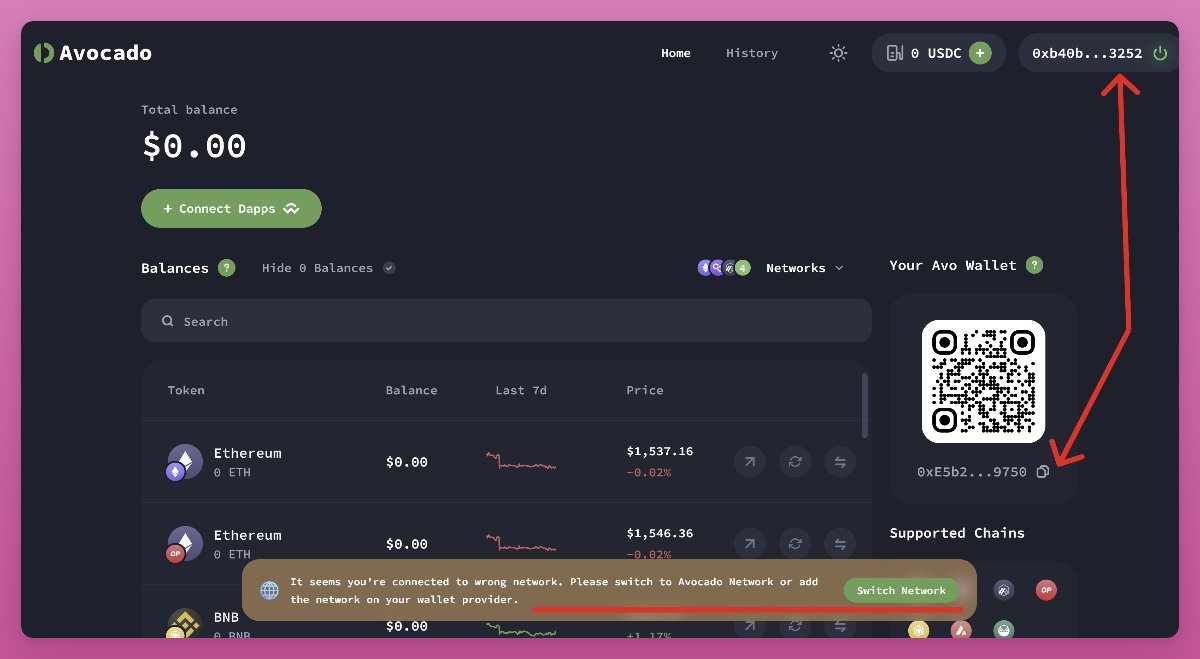

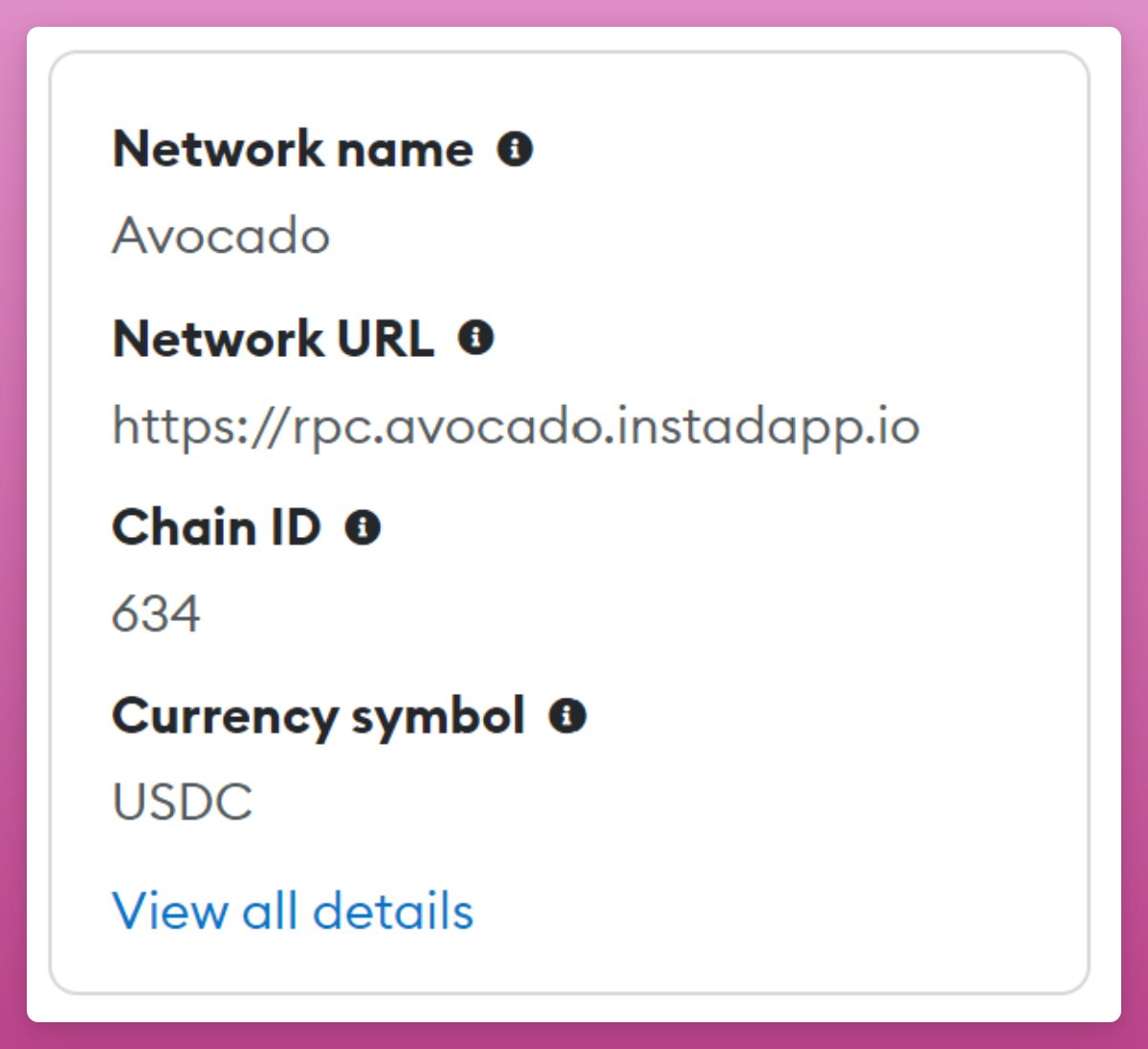

3/ First, you'll connect to Avocado just like any other dApp.

It will ask you to add and switch to the Avocado network.

It has its own RPC (similar to a new blockchain, but it's not).

Then, you'll notice that your Avo Wallet address differs from your Metamask address.

It will ask you to add and switch to the Avocado network.

It has its own RPC (similar to a new blockchain, but it's not).

Then, you'll notice that your Avo Wallet address differs from your Metamask address.

4/ This address is a deterministic smart contract—algorithmically linked to your wallet address.

It's a non-custodial, Account Abstraction wallet that you own.

You can send ANY token from ANY supported chain to this address, and the balance will appear on the Avocado network.

It's a non-custodial, Account Abstraction wallet that you own.

You can send ANY token from ANY supported chain to this address, and the balance will appear on the Avocado network.

5/ Account abstraction is a huge breakthrough for crypto self-custody.

It enables:

• Create & restore a wallet with an email or a phone number

• 1-Click transactions

• App pre-approvals & limits

• 2FA protection

and much more.

It enables:

• Create & restore a wallet with an email or a phone number

• 1-Click transactions

• App pre-approvals & limits

• 2FA protection

and much more.

https://twitter.com/argentHQ/status/1582742559470014464

6/ When adding Avocado Network, you'll see that USDC is used to pay for gas.

You can fund USDC from any chain and use it to pay for transactions on any network.

This means you don't need to manage different gas tokens for different blockchain networks anymore.

You can fund USDC from any chain and use it to pay for transactions on any network.

This means you don't need to manage different gas tokens for different blockchain networks anymore.

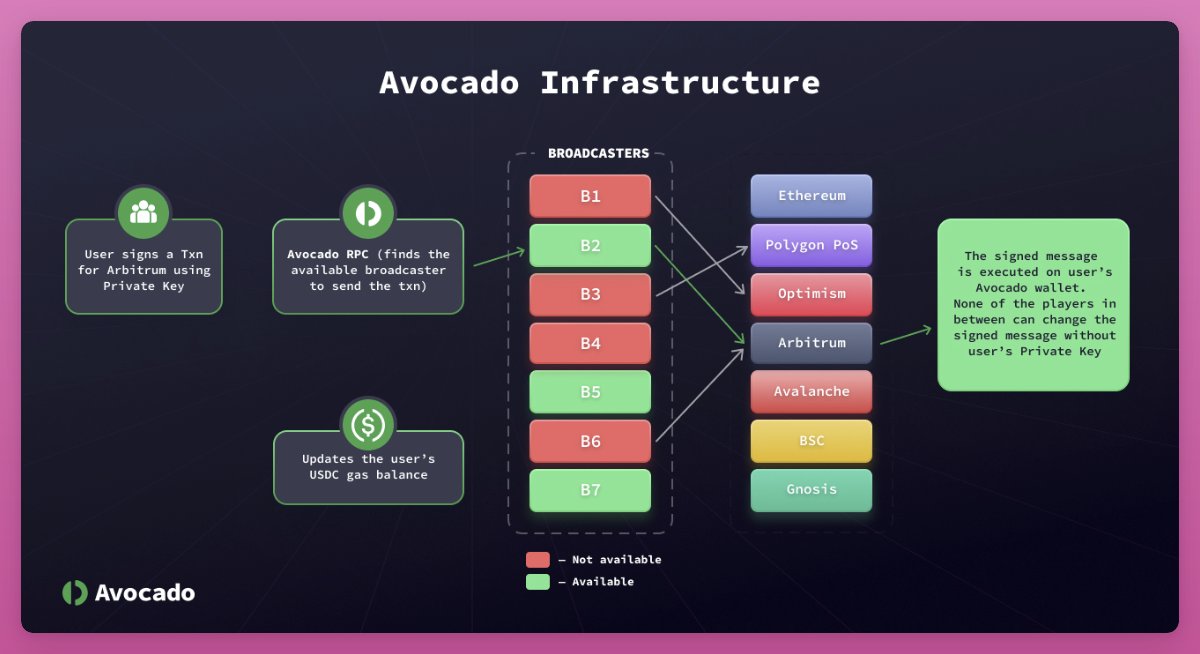

7/ Avocado network has its own RPC, but its not a separate blockchain.

It aggregates all supported blockchains under one hood, while maintaining the same level of security as if you transacted directly on the underlying blockchain.

It aggregates all supported blockchains under one hood, while maintaining the same level of security as if you transacted directly on the underlying blockchain.

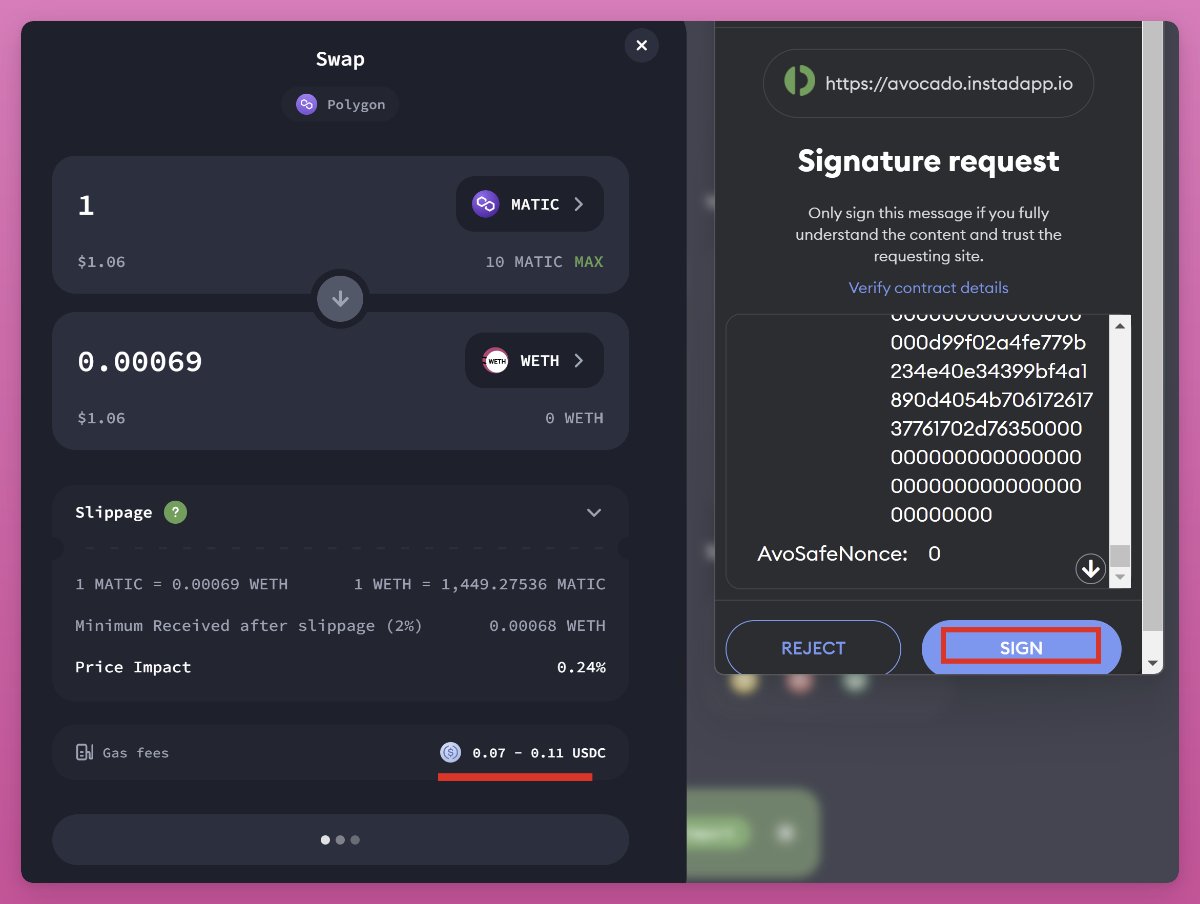

8/ When you use Avocado to make transactions, you'll need to sign a message to the respective chain.

Avocado relays the signed message (signed by your private key) to the respective chain, where gas is paid in the native token (e.g., ETH).

Confused? Just try it.

Avocado relays the signed message (signed by your private key) to the respective chain, where gas is paid in the native token (e.g., ETH).

Confused? Just try it.

9/ That's not all.

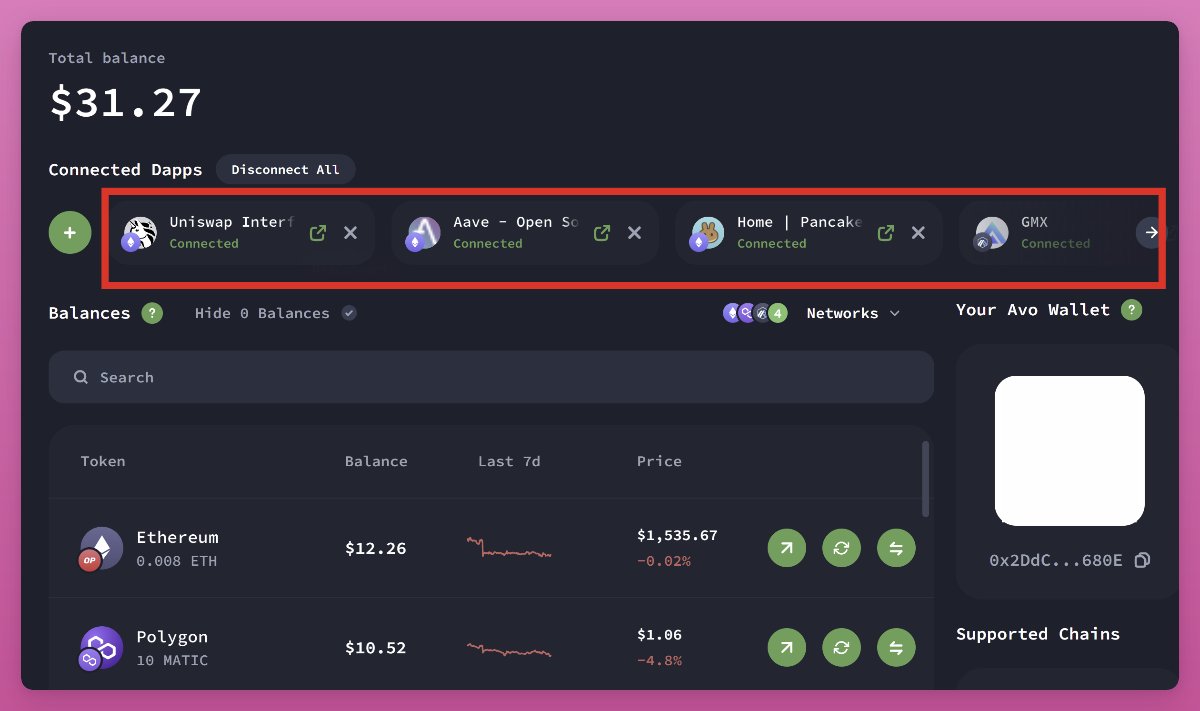

You can connect any dApp to your Avocado wallet.

You'll approve transactions from your Avocado wallet, instead of the dApp itself.

No need to check which chain the dApp is connected to.

While paying the gas in USDC.

You can connect any dApp to your Avocado wallet.

You'll approve transactions from your Avocado wallet, instead of the dApp itself.

No need to check which chain the dApp is connected to.

While paying the gas in USDC.

10/ The end result: You don't need to worry about the chain you're using and what token is used for gas.

Just consider how much you pay for the 'fee'.

Plus, the team will soon introduce a mobile app and a browser extension to further improve user experience.

Just consider how much you pay for the 'fee'.

Plus, the team will soon introduce a mobile app and a browser extension to further improve user experience.

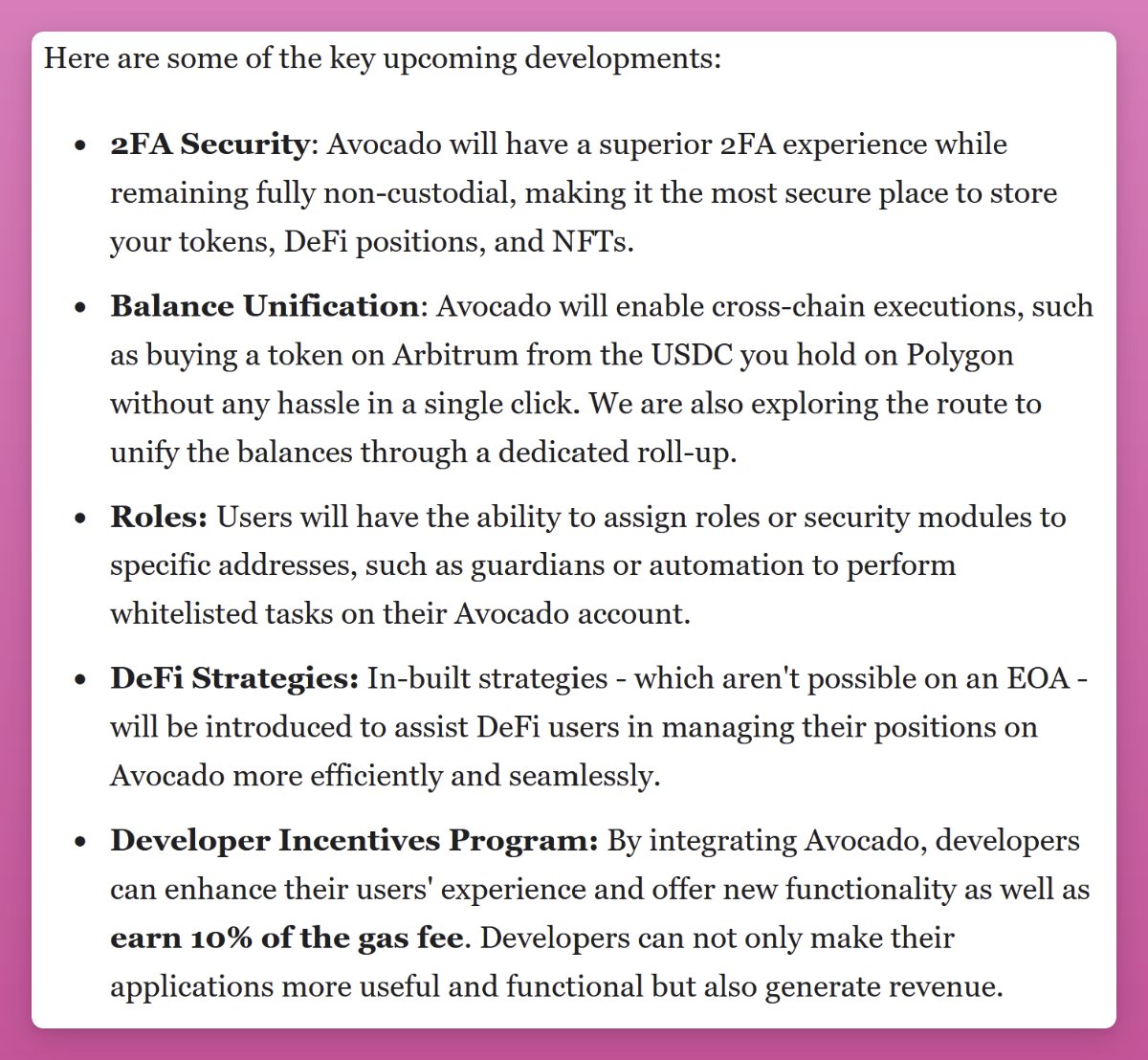

11/ Other key roadmap upgrades include:

• 2FA Security

• Cross-chain balance unification

• Roles for whitelisted tasks to improve security

• In built DeFi strategies

• Incentives program to integrate Avocado directly to the dApps

The last point is a game-changer for dApps.

• 2FA Security

• Cross-chain balance unification

• Roles for whitelisted tasks to improve security

• In built DeFi strategies

• Incentives program to integrate Avocado directly to the dApps

The last point is a game-changer for dApps.

12/ If dApps like Uniswap or Aave integrate Avocado, their users won't need to care which blockchain the app is on – and they can pay fees in USDC.

Plus, dApps will earn 10% of the gas fee, generating more revenue for the dApp DAO.

I wish Uniswap's new mobile app supported it.

Plus, dApps will earn 10% of the gas fee, generating more revenue for the dApp DAO.

I wish Uniswap's new mobile app supported it.

https://twitter.com/DefiIgnas/status/1631873165197729792

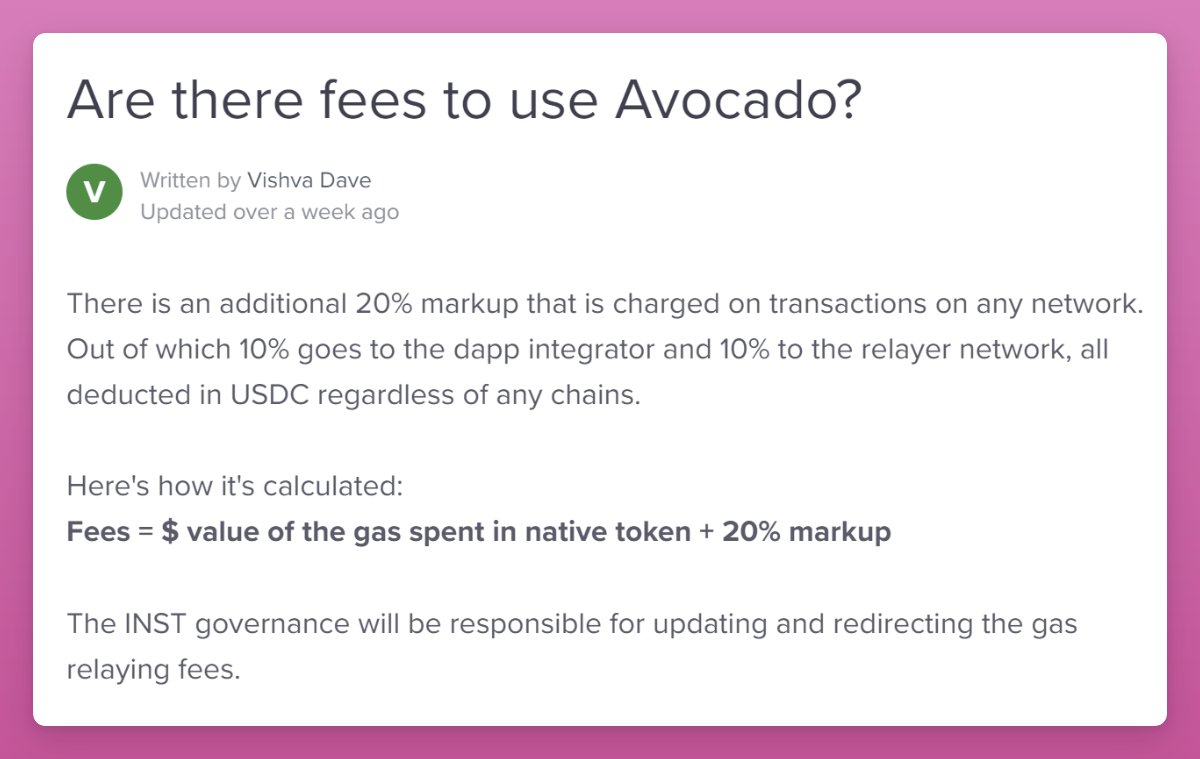

13/ Avocado charges an additional 20% on the gas fee, which can be significant for Ethereum but smaller for other chains like Arbitrum.

Half of the fee would go to the dApp that supports Avocado, making it attractive for them.

The other half will depend on $INST holders.

Half of the fee would go to the dApp that supports Avocado, making it attractive for them.

The other half will depend on $INST holders.

14/ I think, $INST might be one of the most undervalued DeFi tokens. NFA.

It already has $2B in TVL - with the lowest Mcap/TVL ratio in DeFi.

The thing is: Token was of little use. Until now.

With Avocado the revenue from transaction fees will be directed to $INST treasury.

It already has $2B in TVL - with the lowest Mcap/TVL ratio in DeFi.

The thing is: Token was of little use. Until now.

With Avocado the revenue from transaction fees will be directed to $INST treasury.

15/ $INST is backed by prominent investors:

In 2019, Instadapp team raised $2.4M from Pantera Capital, Naval Ravikant, Balaji Srinivasan, Coinbase Ventures, Robot Ventures etc.

They later raised $10M in 2021 at ~$100M valuation.

Current market cap is $18M, and FDV of $105M.

In 2019, Instadapp team raised $2.4M from Pantera Capital, Naval Ravikant, Balaji Srinivasan, Coinbase Ventures, Robot Ventures etc.

They later raised $10M in 2021 at ~$100M valuation.

Current market cap is $18M, and FDV of $105M.

16/ Crypto is getting better and easier to use.

Many more recent developments are contributing to it, like:

• Ethereum EIP-4337 upgrade to say goodbye to complicated seed phrases

• Coinbase is launching Wallet as a Service for customizable on chain wallets

Many more recent developments are contributing to it, like:

• Ethereum EIP-4337 upgrade to say goodbye to complicated seed phrases

• Coinbase is launching Wallet as a Service for customizable on chain wallets

https://twitter.com/johnrising_/status/1631087383440441344

17/ Finally, there's more on-chain data about $INST in my blog.

I just launched Innovation Zone to cover projects like Avocado.

I'll review promising DeFi projects that have the potential to be the next big thing.

ignasdefi.substack.com/p/avocado-a-ga…

I just launched Innovation Zone to cover projects like Avocado.

I'll review promising DeFi projects that have the potential to be the next big thing.

ignasdefi.substack.com/p/avocado-a-ga…

18/ What are your thoughts?

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/DefiIgnas/status/1633626328330289152

• • •

Missing some Tweet in this thread? You can try to

force a refresh