Have you ever wondered how and why Market Makers manipulate the crypto market?

Discover the mystery behind Pumps and Dumps and learn all about Market Makers 👇🧵

Discover the mystery behind Pumps and Dumps and learn all about Market Makers 👇🧵

2/ The information in this thread is based on an AMA made by my friend @Leo_NFD (the founder of @NFD_gg) with the leading Market Making firm @gotbit_io.

If you understand Russian, check out the AMA 🔽

If you understand Russian, check out the AMA 🔽

3/ What we'll be covering:

• Who are Market Makers?

• What are Cash Outs?

• Market Maker's strategies.

• What CEXes are the best for token listings?

• How to recognize that a Market Maker works with a token

• About organic and fake volumes

Let's dive in 🤿

• Who are Market Makers?

• What are Cash Outs?

• Market Maker's strategies.

• What CEXes are the best for token listings?

• How to recognize that a Market Maker works with a token

• About organic and fake volumes

Let's dive in 🤿

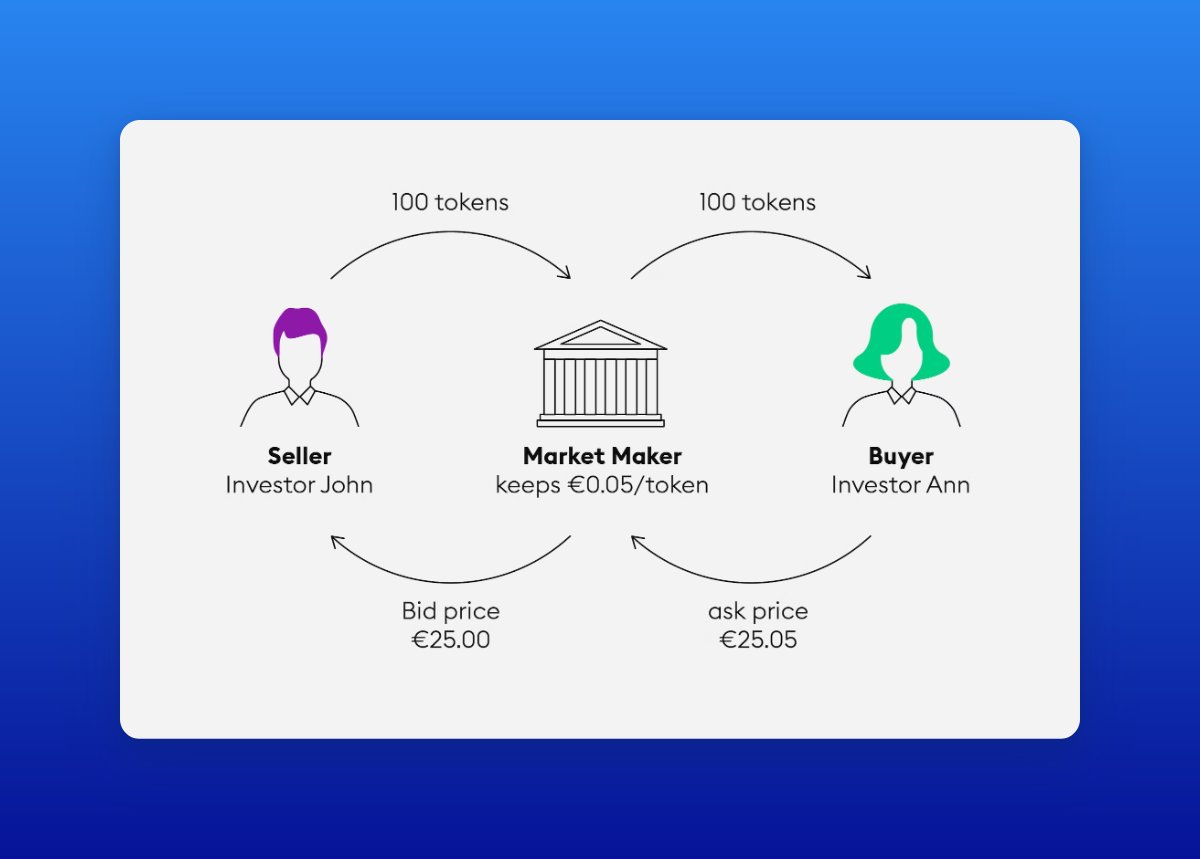

4/ Market-makers facilitate trading in the markets by buying and selling assets, making money from the bid-ask spread.

There are two types of market makers now:

1. Traditional market makers

2. Market makers with project advising

There are two types of market makers now:

1. Traditional market makers

2. Market makers with project advising

5/ Traditional market makers focus on big projects with massive market caps.

Their main goal is to keep the established price, maintain liquidity in the markets, and build a trading strategy for token unlocks.

Their main goal is to keep the established price, maintain liquidity in the markets, and build a trading strategy for token unlocks.

6/ Market makers with project advising:

• Help with project fundraising

• Provide liquidity on DEX

• Develop strategies for token price on TGE

• Help with cash-outs

Thus, these market makers close all the necessities of projects at an early stage.

• Help with project fundraising

• Provide liquidity on DEX

• Develop strategies for token price on TGE

• Help with cash-outs

Thus, these market makers close all the necessities of projects at an early stage.

7/ Cash-Out is basically selling the team's tokens at TGE. Reasons to do it include:

• Raising funds for project development

• Raising funds to buy back seed or private investors' tokens

• Buying "lambos, houses, and yachts" for the project's team

• Raising funds for project development

• Raising funds to buy back seed or private investors' tokens

• Buying "lambos, houses, and yachts" for the project's team

8/ The strategy of market makers depends on the stage of the crypto market. Goals and their fulfillment are built around whether the market is a bull or a bear one.

9/ In a bull market, the main tasks are:

• Give the opportunity to buy a token for any size.

• Make people feel FOMO by looking at the chart.

• Give the opportunity to buy a token for any size.

• Make people feel FOMO by looking at the chart.

10/ In a bear market, the key tasks are:

• Buy the token as cheaply as possible for the next bull run.

• Make some daily trading volume on CEXes to avoid delisting.

• Buy the token as cheaply as possible for the next bull run.

• Make some daily trading volume on CEXes to avoid delisting.

11/ The price of token listing on CEX depends on:

• Popularity of this CEX

• The project's popularity

• Current stage of the market

• Other factors

So, it can vary from free to millions of dollars.

• Popularity of this CEX

• The project's popularity

• Current stage of the market

• Other factors

So, it can vary from free to millions of dollars.

12/ There are 3 tiers of CEXes based on their organic volume:

Tier 1: Binance, Kucoin, and OKX (high buy power of real users, high price for listings).

Tier 2: Gate, MEXC, and Huobi (low buy power, low price for listings).

Tier Rekt: Lbank, Bitrue, etc.

Tier 1: Binance, Kucoin, and OKX (high buy power of real users, high price for listings).

Tier 2: Gate, MEXC, and Huobi (low buy power, low price for listings).

Tier Rekt: Lbank, Bitrue, etc.

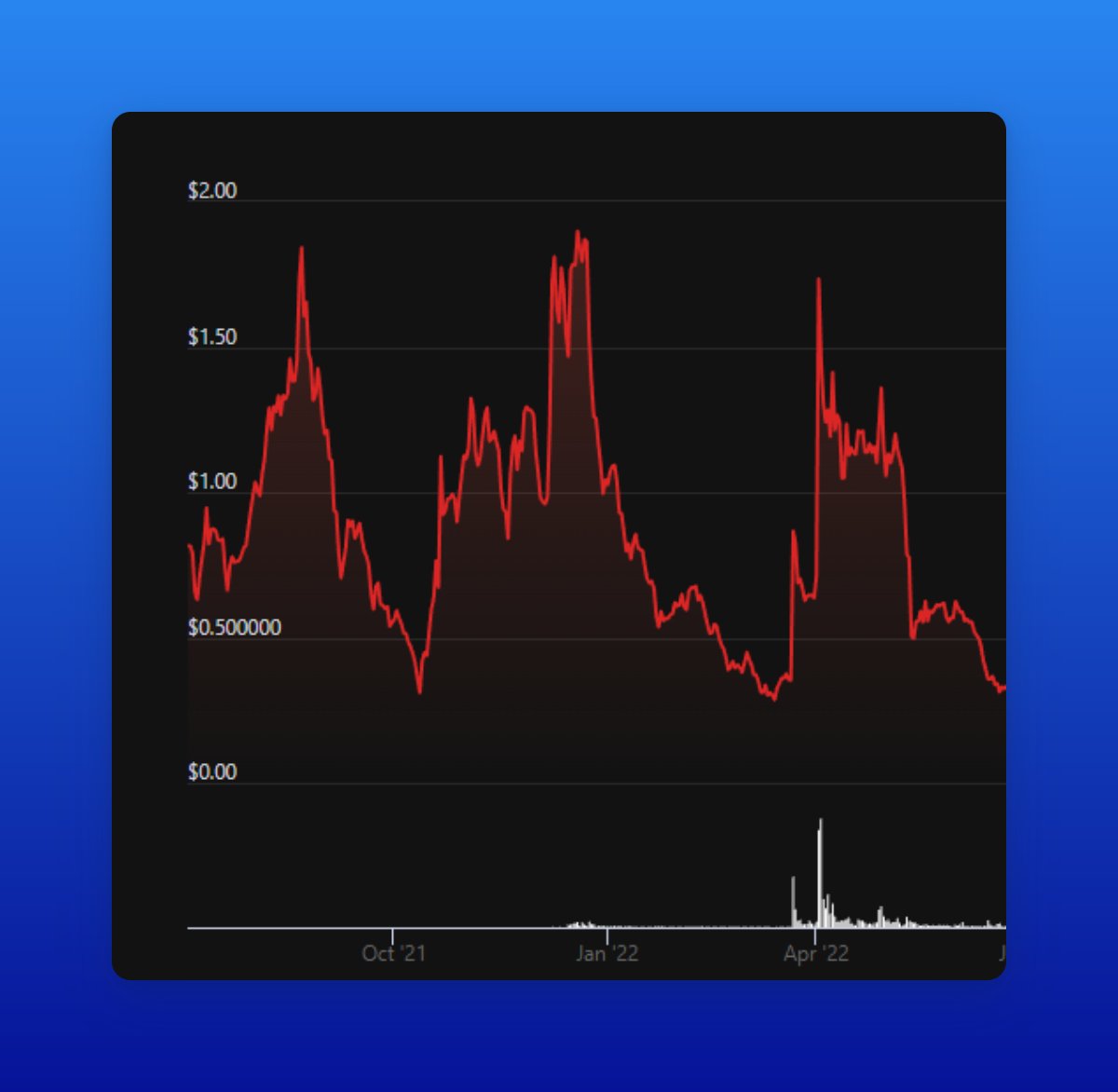

13/ How to recognize that a Market Maker works with a token:

• The token pumped a lot before big news was published.

• Trading volume steadily increases without major price movements.

• Repeating patterns on the chart (e.g., pumps & dumps every couple of months).

• The token pumped a lot before big news was published.

• Trading volume steadily increases without major price movements.

• Repeating patterns on the chart (e.g., pumps & dumps every couple of months).

14/ The trading volume can be organic or fake.

Organic volume is trades of real people, while fake volume is made by artificial orders that market makers execute between their accounts.

Organic volume is trades of real people, while fake volume is made by artificial orders that market makers execute between their accounts.

15/ To recognize fake volume, make a $5-10 buy order:

• If sellers' orders have changed quickly and you can't fill your order for a small amount, there's likely fake volume on this pair.

• If you manage to fill out your order, the volume is probably organic.

• If sellers' orders have changed quickly and you can't fill your order for a small amount, there's likely fake volume on this pair.

• If you manage to fill out your order, the volume is probably organic.

Tagging some Traders:

@QuantMeta

@Tree_of_Alpha

@MrCustomSuit

@Gold_Cryptoz

@conzimp

@Awawat_Trades

@bxresearch

@PC_PR1NCIPAL

@ali_charts

@__bleeker

@ReetikaTrades

@owen1v9

@DarkCryptoLord

@NachoTrades

@RunnerXBT

@hyuktrades

@0xJezza

@PuggyTrades

@QuantMeta

@Tree_of_Alpha

@MrCustomSuit

@Gold_Cryptoz

@conzimp

@Awawat_Trades

@bxresearch

@PC_PR1NCIPAL

@ali_charts

@__bleeker

@ReetikaTrades

@owen1v9

@DarkCryptoLord

@NachoTrades

@RunnerXBT

@hyuktrades

@0xJezza

@PuggyTrades

@QuantMeta @Tree_of_Alpha @MrCustomSuit @Gold_Cryptoz @conzimp @Awawat_Trades @bxresearch @PC_PR1NCIPAL @ali_charts @__bleeker @ReetikaTrades @owen1v9 @DarkCryptoLord @NachoTrades @RunnerXBT @hyuktrades @0xJezza @PuggyTrades Tagging some gigabrains:

@CryptoShiro_

@TheDeFISaint

@rektdiomedes

@crypthoem

@defiprincess_

@DefiIgnas

@DAdvisoor

@Chinchillah_

@Slappjakke

@Subli_Defi

@DeFiMinty

@crypto_linn

@0xsurferboy

@thelearningpill

@0xFlips

@DAdvisoor

@NNovaDefi

@0xTindorr

@CryptoShiro_

@TheDeFISaint

@rektdiomedes

@crypthoem

@defiprincess_

@DefiIgnas

@DAdvisoor

@Chinchillah_

@Slappjakke

@Subli_Defi

@DeFiMinty

@crypto_linn

@0xsurferboy

@thelearningpill

@0xFlips

@DAdvisoor

@NNovaDefi

@0xTindorr

@QuantMeta @Tree_of_Alpha @MrCustomSuit @Gold_Cryptoz @conzimp @Awawat_Trades @bxresearch @PC_PR1NCIPAL @ali_charts @__bleeker @ReetikaTrades @owen1v9 @DarkCryptoLord @NachoTrades @RunnerXBT @hyuktrades @0xJezza @PuggyTrades @CryptoShiro_ @TheDeFISaint @rektdiomedes @crypthoem @defiprincess_ @DefiIgnas @DAdvisoor @Chinchillah_ @Slappjakke @Subli_Defi @DeFiMinty @crypto_linn @0xsurferboy @thelearningpill @0xFlips @NNovaDefi @0xTindorr I hope you've found this thread helpful.🙏

Follow me @rektfencer for more

Like/Comment/Retweet the first tweet below if you can.

Follow me @rektfencer for more

Like/Comment/Retweet the first tweet below if you can.

https://twitter.com/rektfencer/status/1629798901518589952?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh