It’s time for Uniswap v3 to launch on @avalancheavax

After consulting with @avalabsofficial, we @UMichBlockchain have released a proposal on the Uni forums describing why this deployment is important

Let’s break down the proposal step by step👇

After consulting with @avalabsofficial, we @UMichBlockchain have released a proposal on the Uni forums describing why this deployment is important

Let’s break down the proposal step by step👇

The urgency behind this proposal is due to the impending license expiration

After April 1st, anyone can legally fork Uni v3 code and use it for commercial purposes

Large chains like Avalanche will see a rapid influx of v3 copycats

This will dilute the market on those chains

After April 1st, anyone can legally fork Uni v3 code and use it for commercial purposes

Large chains like Avalanche will see a rapid influx of v3 copycats

This will dilute the market on those chains

So it’s paramount for Uniswap v3 to get ahead of the competitors by launching on large chains before duplicates arise

On Avalanche specifically, we know that duplicate chains will spring quickly because it already has lots of liquidity ($950M TVL) and innovation (281+ protocols)

On Avalanche specifically, we know that duplicate chains will spring quickly because it already has lots of liquidity ($950M TVL) and innovation (281+ protocols)

One of the reasons for Avalanche’s continual growth is its novel architecture

It is broken into three parts: P-Chain, C-Chain, & X-Chain

This 3-pronged setup optimizes for scalability and interoperability

It is broken into three parts: P-Chain, C-Chain, & X-Chain

This 3-pronged setup optimizes for scalability and interoperability

The three chains compose a consortium of validators called the Primary Network

It is responsible for Avalanche’s security

Plus, the security easily compounds because increasing the # of validators does not sacrifice block time

This allows for higher decentralization over time

It is responsible for Avalanche’s security

Plus, the security easily compounds because increasing the # of validators does not sacrifice block time

This allows for higher decentralization over time

In Q4 2022, Avalanche’s Nakamoto coefficient increased from 30 to 32

This surpass most other L1s

Plus, the chain currently touts a whopping 1,226 validators & over 233M AVAX tokens staked

These are all signs of a robust L1

This surpass most other L1s

Plus, the chain currently touts a whopping 1,226 validators & over 233M AVAX tokens staked

These are all signs of a robust L1

Avalanche also permits high scalability via its ecosystem of subnets

Like Ethereum’s L2s, subnets allow for outsourcing blockspace from the Primary Network to alternative blockchains

As congestion increases on the EVM-compatible C-Chain, projects will create their own subnet

Like Ethereum’s L2s, subnets allow for outsourcing blockspace from the Primary Network to alternative blockchains

As congestion increases on the EVM-compatible C-Chain, projects will create their own subnet

The beauty of subnets is that they enable launching application-specific blockchains w/t full customizability

This grants builders control over their dev stack

All subnets can specify their own execution logic, fee regime, state, networking, and security

This grants builders control over their dev stack

All subnets can specify their own execution logic, fee regime, state, networking, and security

Large protocols that initially relied on the C-Chain are now migrating to their individualized subnets

Notable examples of this are @DeFiKingdoms and @StepApp_

And as more subnets join the network, Avalanche’s security simultaneously increases

Notable examples of this are @DeFiKingdoms and @StepApp_

And as more subnets join the network, Avalanche’s security simultaneously increases

https://twitter.com/DeFiKingdoms/status/1624194786574860292

Avalanche also has a strong user base

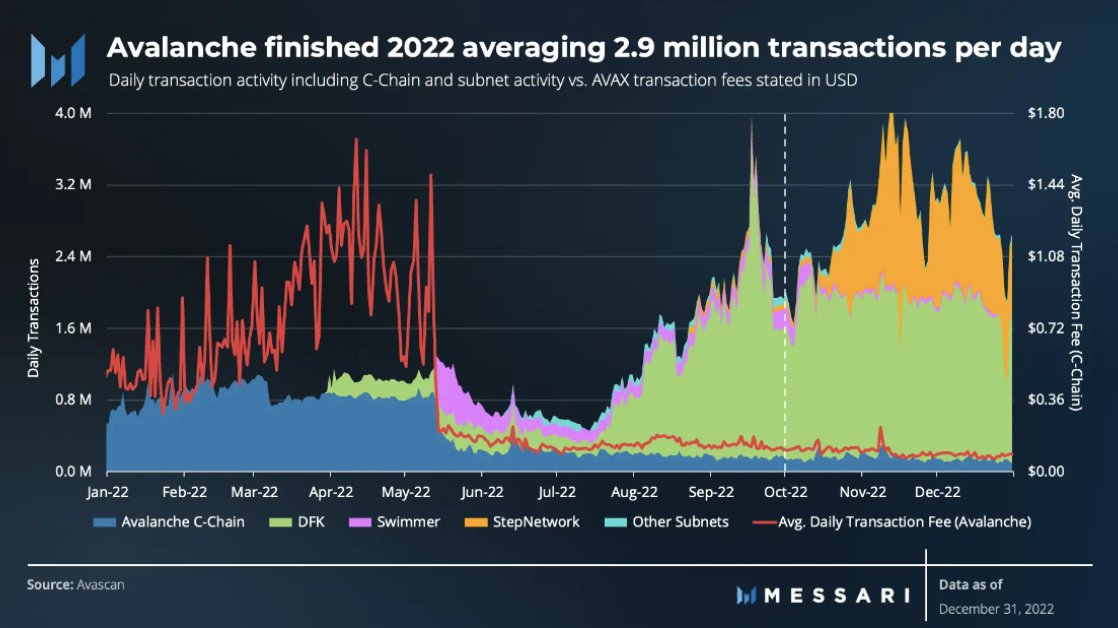

Although daily active users remained relatively steady since Summer 2022, average daily transactions increased from ~1M to ~3M

This indicates the emergence of power users

Although daily active users remained relatively steady since Summer 2022, average daily transactions increased from ~1M to ~3M

This indicates the emergence of power users

However, Uniswap would not be without competition

Post deployment, the most fierce competitor on Avalanche for Uni v3 will be Trader Joe

In a single day this week, @traderjoe_xyz saw nearly $100M in volume

Post deployment, the most fierce competitor on Avalanche for Uni v3 will be Trader Joe

In a single day this week, @traderjoe_xyz saw nearly $100M in volume

But this level of activity only illustrates Avalanche’s DeFi market size

Even though Trader Joe v2 is equipped with a concentrated liquidity mechanism comparable to Uni v3, Uniswap has a stronger, more established brand

This allows Uni to attract liquidity from existing DEXs

Even though Trader Joe v2 is equipped with a concentrated liquidity mechanism comparable to Uni v3, Uniswap has a stronger, more established brand

This allows Uni to attract liquidity from existing DEXs

A notable anecdote is when Uni v3 launched on @0xPolygon

After deployment, Uniswap quickly acquired market share from both @QuickswapDEX and @SushiSwap

Although this experiment is yet to be tested on a large alt L1, it is likely that a similar pattern will surface on Avalanche

After deployment, Uniswap quickly acquired market share from both @QuickswapDEX and @SushiSwap

Although this experiment is yet to be tested on a large alt L1, it is likely that a similar pattern will surface on Avalanche

Apart from DeFi activity, Avalanche has also made strides in sectors like gaming, NFTs, and user adoption

Further innovation in each of these categories is enabled by a DEX like Uniswap

And in turn, Uniswap stakeholders will attain value from the protocol’s increased usage

Further innovation in each of these categories is enabled by a DEX like Uniswap

And in turn, Uniswap stakeholders will attain value from the protocol’s increased usage

Avalanche NFT Progression in 2022:

- @opensea launched natively on Avalanche

- NFT Minter app (built on Avalanche) integrated with @Shopify

- @joepegsnft, an NFT marketplace, launched in Q2 2022 and became the most used NFT market on Avalanche (50+ projects onboarded)

- @opensea launched natively on Avalanche

- NFT Minter app (built on Avalanche) integrated with @Shopify

- @joepegsnft, an NFT marketplace, launched in Q2 2022 and became the most used NFT market on Avalanche (50+ projects onboarded)

Avalanche Gaming Progression in 2022:

- Numerous subnets for gaming launched

- @DeFiKingdoms subnet generated 1-2M txn/day in Q4 2022

- @swimmer_network subnet integrated @snakecity_io & @PlayCrabada

- Japanese media company @GREEgames partnered with Avalanche to build games

- Numerous subnets for gaming launched

- @DeFiKingdoms subnet generated 1-2M txn/day in Q4 2022

- @swimmer_network subnet integrated @snakecity_io & @PlayCrabada

- Japanese media company @GREEgames partnered with Avalanche to build games

Avalanche User Adoption in 2022:

- Ava Labs enacted developments for Avalanche's multichain wallet, @coreapp

- Fiat onramps have been added to Core using Coinbase Pay

- Core Web and Mobile released, allowing for seamless navigation of Avalanche's ecosystem

- Ava Labs enacted developments for Avalanche's multichain wallet, @coreapp

- Fiat onramps have been added to Core using Coinbase Pay

- Core Web and Mobile released, allowing for seamless navigation of Avalanche's ecosystem

Now what about the bridge?

How should we address cross-chain messaging?

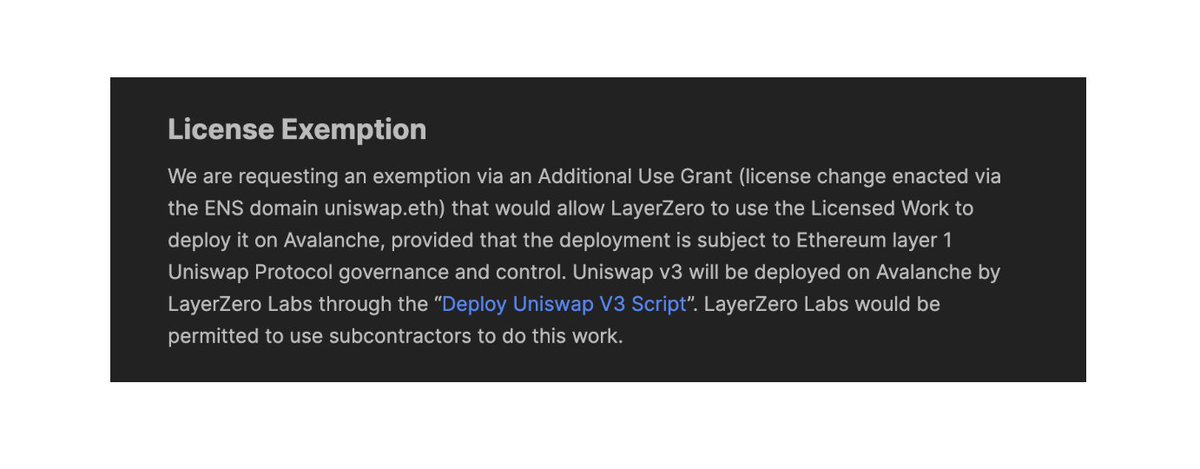

We propose using LayerZero, an omnichain bridging solution, to facilitate cross-chain message passing between Ethereum and Avalanche

How should we address cross-chain messaging?

We propose using LayerZero, an omnichain bridging solution, to facilitate cross-chain message passing between Ethereum and Avalanche

Although the Uni DAO previously voted to use @wormholecrypto for the BNB Chain deployment

We believe that such a decision should not set a precedent for future bridge selection

We need to try our hand at testing out different, reliable bridges

We believe that such a decision should not set a precedent for future bridge selection

We need to try our hand at testing out different, reliable bridges

https://twitter.com/wormholecrypto/status/1624051141033033729?lang=en

A handful of Uni delegates and tokenholders have also pioneered a new messaging system

Using this setup, cross-chain governance relies not on a single bridge but simultaneously on a handful of bridges

Using this setup, cross-chain governance relies not on a single bridge but simultaneously on a handful of bridges

https://twitter.com/StanfordCrypto/status/1629577192601714689?s=20

Yes, we see the merits of a multi-bridge system

But it may take some time for this approach to garner adoption and be fully vetted

The Uni DAO can decide to opt into a multi-bridge system in the future

But for an agile deployment, we believe that LayerZero is the best solution

But it may take some time for this approach to garner adoption and be fully vetted

The Uni DAO can decide to opt into a multi-bridge system in the future

But for an agile deployment, we believe that LayerZero is the best solution

Another reason for using LayerZero is their existing relationship with Avalanche

The first use case of Omnichain Fungible Token (OFT) transfer has been active for nearly 4 months on Avalanche, enabling a composable, unified liquidity system for BTC

The first use case of Omnichain Fungible Token (OFT) transfer has been active for nearly 4 months on Avalanche, enabling a composable, unified liquidity system for BTC

https://twitter.com/LayerZero_Labs/status/1593305261204463616?s=20

The LayerZero-Avalanche relationship is in part why @LayerZero_Labs has volunteered to take care of the technical deployment of v3 on Avalanche

Again, our goal is for this process to take the path of least resistance due to the timely nature of the proposal

Again, our goal is for this process to take the path of least resistance due to the timely nature of the proposal

But is LayerZero safe to use?

In short, yes.

- LZ is supported by thousands of cross-chain builders w/t over 2k contracts deployed on mainnet

- Has ~700 unique apps

- ~2M total messages

- ~$5B txn volume

- And billions of dollars in TVL

In short, yes.

- LZ is supported by thousands of cross-chain builders w/t over 2k contracts deployed on mainnet

- Has ~700 unique apps

- ~2M total messages

- ~$5B txn volume

- And billions of dollars in TVL

The two main components for LZ messaging are the Oracle and the Relayer

The Oracle sends block headers from the source chain to the destination chain

The Relayer sends txn proofs from the source chain to the destination chain

The Oracle sends block headers from the source chain to the destination chain

The Relayer sends txn proofs from the source chain to the destination chain

The Oracle and Relayer work together to pass messages between chains

But the underlying assumption behind this model is that the two entities don’t collude

If they do, then the entire system falls apart

So what makes sure that they don’t collude?

But the underlying assumption behind this model is that the two entities don’t collude

If they do, then the entire system falls apart

So what makes sure that they don’t collude?

Unlike other bridges, LZ doesn’t pose an economic stake or bond to punish malicious actors via a slashing mechanism

Instead, if the default oracle-relayer configuration is compromised, then there is a reputational backlash for those running the Oracle and Relayer

Instead, if the default oracle-relayer configuration is compromised, then there is a reputational backlash for those running the Oracle and Relayer

With a default configuration, LZ runs the Relayer

And Chainlink runs the Oracle

The Chainlink DON would have to actively collude with the LayerZero Labs Relayer at the same time to enable passing of a malicious message

And Chainlink runs the Oracle

The Chainlink DON would have to actively collude with the LayerZero Labs Relayer at the same time to enable passing of a malicious message

If LZ and Chainlink collude, then both will take an enormous hit to their reputations

This makes the incentive of collusion minimal

Plus, if Uniswap does not want LZ or Chainlink to run either one or both of the Relayer or Oracle, Uniswap can do so itself

This makes the incentive of collusion minimal

Plus, if Uniswap does not want LZ or Chainlink to run either one or both of the Relayer or Oracle, Uniswap can do so itself

LZ code is also set in stone

The smart contracts are not upgradable

This is a big deal since most exploits occur due to bugs in code–not due to malicious actors colluding

And the easiest way to introduce new bugs is to upgrade the baseline code

The smart contracts are not upgradable

This is a big deal since most exploits occur due to bugs in code–not due to malicious actors colluding

And the easiest way to introduce new bugs is to upgrade the baseline code

It’s therefore important for the current code to be pristine

How do we judge code to be bug free?

Audits.

LZ has been audited over 35 times AND reviewed numerous times internally by the @LayerZero_Labs team

How do we judge code to be bug free?

Audits.

LZ has been audited over 35 times AND reviewed numerous times internally by the @LayerZero_Labs team

Plus, LZ’s current track record is very clean

They’re the only major cross-chain messaging protocol with billions in TVL to not be exploited

And as a further safeguard, LZ has the largest live bug bounty program in the industry ($15M)

They’re the only major cross-chain messaging protocol with billions in TVL to not be exploited

And as a further safeguard, LZ has the largest live bug bounty program in the industry ($15M)

https://twitter.com/PrimordialAA/status/1509993139007750147?s=20

So, because of Avalanche’s continual expansion and growing DeFi ecosystem, along with LZ’s robust cross-chain messaging architecture, we believe that it’s finally time for @Uniswap to deploy on Avalanche

https://twitter.com/UMichBlockchain/status/1629279824257638400?s=20

Special thanks to @luigidemeo from Ava Labs & @IreneWu27 from LayerZero Labs for their aid in this proposal

If you’re interested in diving into more threads, check out these chads:

@TheDeFISaint

@rektdiomedes

@Chinchillah_

@jake_pahor

@crypto_linn

@thelearningpill

@DeFiMinty

@arndxt_xo

@0xSalazar

@0xFlips

@0xsurferboy

@0xCrypto_doctor

@_FabianHD

@Slappjakke

@TheDeFISaint

@rektdiomedes

@Chinchillah_

@jake_pahor

@crypto_linn

@thelearningpill

@DeFiMinty

@arndxt_xo

@0xSalazar

@0xFlips

@0xsurferboy

@0xCrypto_doctor

@_FabianHD

@Slappjakke

https://twitter.com/abdullahbumar/status/1629608358842974209?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh