1/x

I read @MessariCrypto’s 168-page report on EVERYTHING web3 so you don’t have to.

(DeFi, NFTs, Trends etc..)

Let’s dive in.. 🧵

I read @MessariCrypto’s 168-page report on EVERYTHING web3 so you don’t have to.

(DeFi, NFTs, Trends etc..)

Let’s dive in.. 🧵

2/x

Winter is Here ❄️

- speculative mania gone

- true believers remain

- fundamentals stronger than before

- most important time in crypto history to focus and learn / stick around

Winter is Here ❄️

- speculative mania gone

- true believers remain

- fundamentals stronger than before

- most important time in crypto history to focus and learn / stick around

3/x

Crypto still inevitable 🤌

- innovation overshadowed by scams

- Bitcoin & ETH in historic ‘buy range’

- stablecoins rival global card networks (visa..)

- L1s scaling & lowering fees

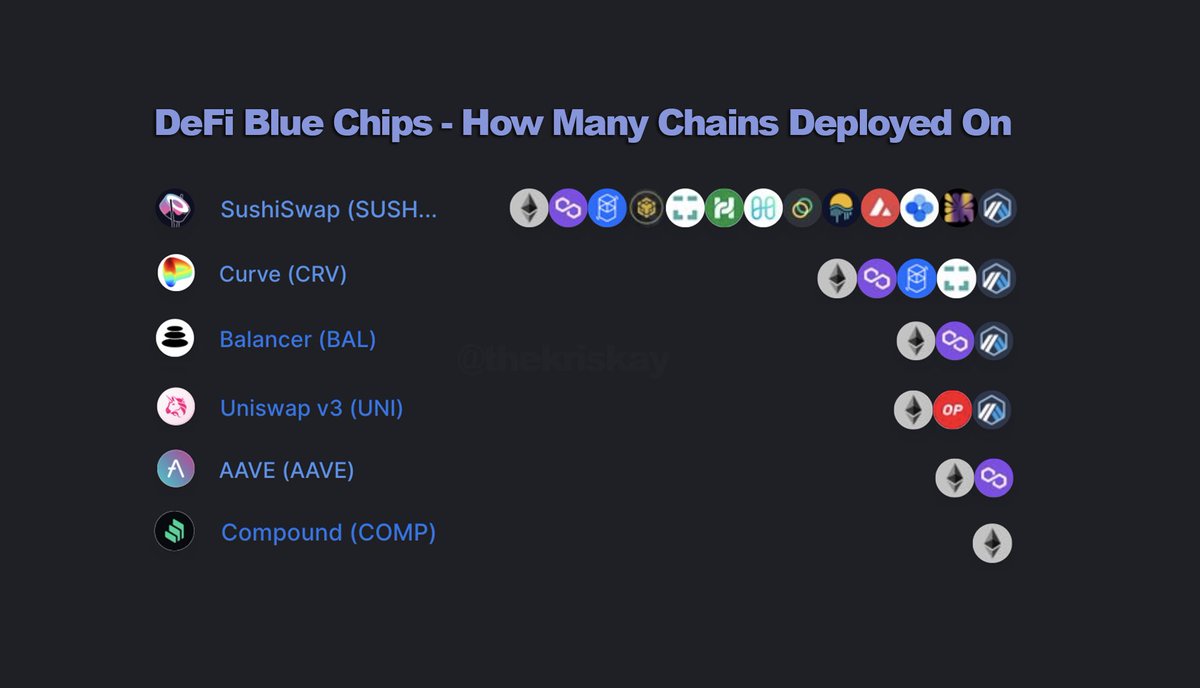

- DeFi 1.0 working without hiccups

Crypto still inevitable 🤌

- innovation overshadowed by scams

- Bitcoin & ETH in historic ‘buy range’

- stablecoins rival global card networks (visa..)

- L1s scaling & lowering fees

- DeFi 1.0 working without hiccups

4/x

Back to Basics 📊

- we now have Analysis tools

- fundamentals are emerging

- easier to research coins

- BS coins will fade bc of these tools

- currently 13 dapps with $10m run rate revenue

Back to Basics 📊

- we now have Analysis tools

- fundamentals are emerging

- easier to research coins

- BS coins will fade bc of these tools

- currently 13 dapps with $10m run rate revenue

5/x

VC money still exists 💰

- ‘21 - mid ‘22 = $55b of investments

- 2nd half of ‘22 VC investments down 70%

- VC investments slowed but still going

VC money still exists 💰

- ‘21 - mid ‘22 = $55b of investments

- 2nd half of ‘22 VC investments down 70%

- VC investments slowed but still going

6/x

Exchanges 👨💼

- Coinbase & Binance dominate

- FTX failure led to increased transparency standards

- regulatory risks for smaller exchanges are present

Exchanges 👨💼

- Coinbase & Binance dominate

- FTX failure led to increased transparency standards

- regulatory risks for smaller exchanges are present

7/x

Crypto Credit Crisis 🥵

- 3AC & BlockFi bought GBTC

- GBTC premium crashed

- 3AC & BlockFi got trapped,

- & borrowed against GBTC

- Genesis loaned them $

- Luna was BIG blow

- 3AC & BlockFi gave Genesis bad debt

- FTX final blow

- Dominos & contagion

Crypto Credit Crisis 🥵

- 3AC & BlockFi bought GBTC

- GBTC premium crashed

- 3AC & BlockFi got trapped,

- & borrowed against GBTC

- Genesis loaned them $

- Luna was BIG blow

- 3AC & BlockFi gave Genesis bad debt

- FTX final blow

- Dominos & contagion

8/x

StableCoins ⚖️

- should be USA leading export

- huge potential & scale

- first govt player will benefit big time

- stablecoin settlement rivaling big payments players like visa / Mastercard / PayPal

- hundred billion+ $$ market cap

StableCoins ⚖️

- should be USA leading export

- huge potential & scale

- first govt player will benefit big time

- stablecoin settlement rivaling big payments players like visa / Mastercard / PayPal

- hundred billion+ $$ market cap

9/x

What’s @VitalikButerin excited about? 🤴

- privacy preserving stable coins

- Prediction markets! (Fun)

- identity modules (ENS etc)

- Hybrid applications (on+off chain) for things like voting

What’s @VitalikButerin excited about? 🤴

- privacy preserving stable coins

- Prediction markets! (Fun)

- identity modules (ENS etc)

- Hybrid applications (on+off chain) for things like voting

10/x

Revenge of the dApps 💻

- DeFi TVL = $40 billion

- Fin. services industry = $23 trillion

- huge market to be had for DeFi apps

- growth upside is big

Revenge of the dApps 💻

- DeFi TVL = $40 billion

- Fin. services industry = $23 trillion

- huge market to be had for DeFi apps

- growth upside is big

11/x

The @Uniswap Unicorn:🦄

- currently only $1b+ protocol

- V3 update was huge

- likely to keep its dominance

- dividend ‘fee switch’ going into trial run

The @Uniswap Unicorn:🦄

- currently only $1b+ protocol

- V3 update was huge

- likely to keep its dominance

- dividend ‘fee switch’ going into trial run

12/x

Real world collateral (DeFi) 💰

- overcollat lending dries up when risk off

- undercollat lending popping up in DeFi (@goldfinch_fi, @maplefinance)

- DeFi will need to create more uncollateralized lending to compete with banks

Real world collateral (DeFi) 💰

- overcollat lending dries up when risk off

- undercollat lending popping up in DeFi (@goldfinch_fi, @maplefinance)

- DeFi will need to create more uncollateralized lending to compete with banks

13/x

Rise of liquid staking 💧

- stETH & rETH huge growth

- risk of staking ETH falling,

- little reason NOT to stake ETH

- synthetic assets give utility & will create long term hodlers

@LidoFinance & @Rocket_Pool

Rise of liquid staking 💧

- stETH & rETH huge growth

- risk of staking ETH falling,

- little reason NOT to stake ETH

- synthetic assets give utility & will create long term hodlers

@LidoFinance & @Rocket_Pool

14/x

Generative art / NFTs 🖼️

- NFT market est value $8b-$10b

- 2/3 of NFT value = profile pics

- NFTs in gaming has big potential

- NFTs bleeding into every industry

- NFTs disrupting creator monetization

Generative art / NFTs 🖼️

- NFT market est value $8b-$10b

- 2/3 of NFT value = profile pics

- NFTs in gaming has big potential

- NFTs bleeding into every industry

- NFTs disrupting creator monetization

15/x

GameFi 🎮

- gaming x finance

- trad gaming extracts value from players

- GameFi gives value back

- enjoyable games lacking still

GameFi 🎮

- gaming x finance

- trad gaming extracts value from players

- GameFi gives value back

- enjoyable games lacking still

16/x

DeSo 💬

- decentralized social gaining steam

- on-chain reputation / ownership

- give value back to users

- @LensProtocol leading the way as ground level platform

DeSo 💬

- decentralized social gaining steam

- on-chain reputation / ownership

- give value back to users

- @LensProtocol leading the way as ground level platform

17/x

Wallets 🪪

- wallet abstraction needed

- @coinbase web3 in-app wallet 🔥

- great wallet experience needed for payment adoption

- @zapper_fi & @nansen_ai explorers are huge help for investors / users

Wallets 🪪

- wallet abstraction needed

- @coinbase web3 in-app wallet 🔥

- great wallet experience needed for payment adoption

- @zapper_fi & @nansen_ai explorers are huge help for investors / users

18/x

I did my best to cut the fat and condense this report, but there’s still a lot of information to be absorbed, shout-out to @twobitidiot & @MessariCrypto for putting it together, go read it for yourself on the Messari website (free)

I did my best to cut the fat and condense this report, but there’s still a lot of information to be absorbed, shout-out to @twobitidiot & @MessariCrypto for putting it together, go read it for yourself on the Messari website (free)

19/x

Twitter BUGGED tf out and posted this thread like twice then deleted itself etc idk but all is good now 😂

If you enjoyed it, pls give the main tweet a RT / share:

Twitter BUGGED tf out and posted this thread like twice then deleted itself etc idk but all is good now 😂

If you enjoyed it, pls give the main tweet a RT / share:

https://twitter.com/thekriskay/status/1606352463644196886?s=20&t=w9bQ1Q96brXtSwL0zZaogA

• • •

Missing some Tweet in this thread? You can try to

force a refresh