The most anticipated launch for @chainlink in 2022 is staking 🥩

Here's a thread breaking down what it means, how it will be implemented, and why you should care 🧵

Here's a thread breaking down what it means, how it will be implemented, and why you should care 🧵

Let's start by understanding where 'staking' started

The first popular consensus mechanism for layer-1 blockchains was Proof of Work (PoW), which requires participants to expend energy to help secure the network

However, Proof of Stake (PoS) has recently gained popularity

The first popular consensus mechanism for layer-1 blockchains was Proof of Work (PoW), which requires participants to expend energy to help secure the network

However, Proof of Stake (PoS) has recently gained popularity

PoS requires network participants to lock their crypto assets in a smart contract in exchange for becoming a 'validator' node that helps secure/validate transactions & gets rewarded

If a validator is caught misbehaving, a portion of their staked assets is reduced via 'slashing'

If a validator is caught misbehaving, a portion of their staked assets is reduced via 'slashing'

Ultimately staking on layer-1 blockchains is all about aligning incentives and creating cryptoeconomic security

While Blockchains & DONs have some differences, they still have to solve many similar problems. It turns out staking can be leveraged by both

While Blockchains & DONs have some differences, they still have to solve many similar problems. It turns out staking can be leveraged by both

https://twitter.com/alex_valaitis/status/1546595078780493824?s=20&t=-TmJjlZFQ0eS0Vf2N06c2g

The ultimate goal of staking for Chainlink is to increase the cryptoeconomic security of its services.

Here is a high-level overview of how staking will be implemented to accomplish this goal:

Here is a high-level overview of how staking will be implemented to accomplish this goal:

1) Nodes will have to stake $LINK via 2 deposits (1 that's slashed if providing bad data & 1 that's slashed if improperly alerting about a bad oracle network)

2) If an oracle network reports a value that deviates outside of the service level agreement (SLA) it can be reported.

2) If an oracle network reports a value that deviates outside of the service level agreement (SLA) it can be reported.

3) This report is then raised to a second-tier adjudicator that decides whether or not the value provided did break the SLA.

4) If an oracle network is found to have broken the SLA, then the $LINK staked by all nodes/delegators in that network will be slashed as punishment.

4) If an oracle network is found to have broken the SLA, then the $LINK staked by all nodes/delegators in that network will be slashed as punishment.

5) Nodes that behave, will be rewarded in $LINK for staking and securing Chainlink services.

These rewards will be covered by the Chainlink treasury short term, but long term the goal is to have it be covered in fees paid by projects paying for Chainlink services.

These rewards will be covered by the Chainlink treasury short term, but long term the goal is to have it be covered in fees paid by projects paying for Chainlink services.

Now there's a bunch of important nuances behind how Chainlink staking will be implemented, but I wanted to hone in on 4 parts in particular:

Super-linear staking, implicit vs explicit staking, solving diminishing returns on security, community participation

Super-linear staking, implicit vs explicit staking, solving diminishing returns on security, community participation

1) Super-linear staking: As laid out in the Chainlink 2.0 whitepaper, the staking mechanism design will make it such that, as the number of oracle nodes staking increases, an attacker will need to budget a quadratically greater amount of $ to successfully execute an attack.

This is important for ensuring cryptoeconomic security, otherwise it would be easy to bribe nodes

If I could see how much each node was staking, I'd just have to bribe slightly more for each node & corrupt a job that had a bigger payout

Superlinear staking makes this unfeasible

If I could see how much each node was staking, I'd just have to bribe slightly more for each node & corrupt a job that had a bigger payout

Superlinear staking makes this unfeasible

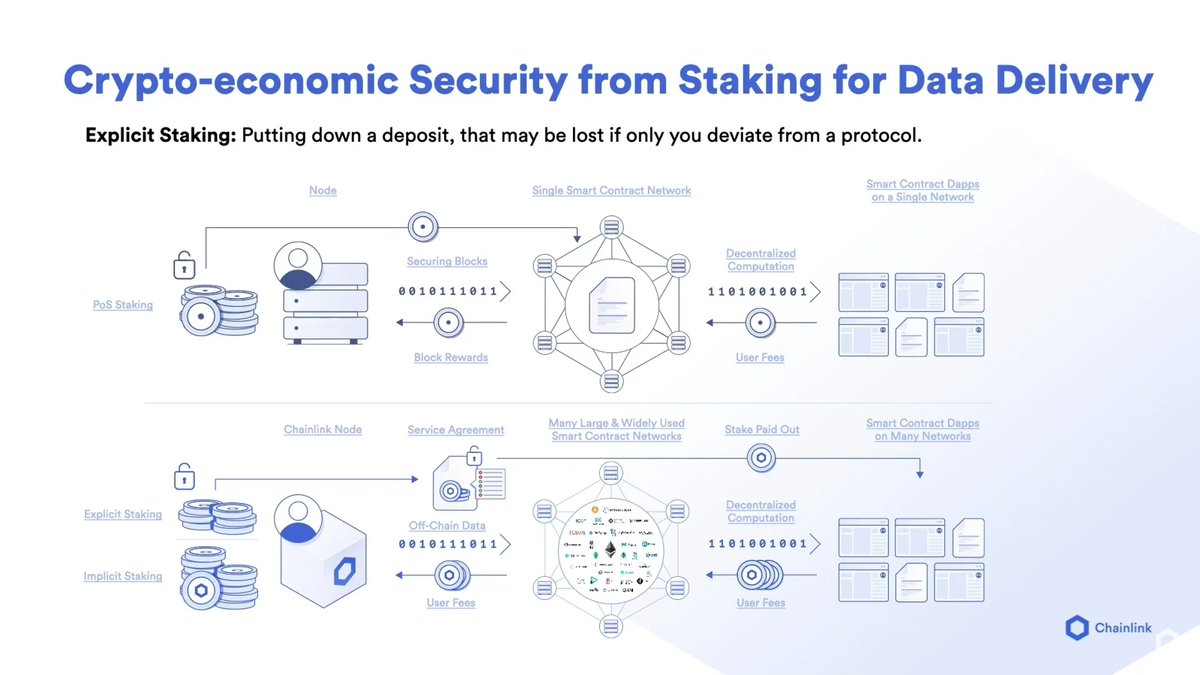

2) Implicit vs explicit staking: We noted how staking requires nodes to make 2 deposits, which acts as explicit incentives.

However, there is also implicit staking, in the sense that misbehavior can hurt value of existing holdings of $LINK

(Not to mention lost future earnings)

However, there is also implicit staking, in the sense that misbehavior can hurt value of existing holdings of $LINK

(Not to mention lost future earnings)

3) Solving diminishing returns on security: Over time, nodes will reach parity in terms of performance.

To decide which nodes will win higher-value jobs, nodes can stake more $LINK as a tie-breaker, increasing network security in the process (more $LINK that can be slashed)

To decide which nodes will win higher-value jobs, nodes can stake more $LINK as a tie-breaker, increasing network security in the process (more $LINK that can be slashed)

4) Community participation: Staking is the 1st real use case that allows for general community participation. This can be done via alerting on bad actors (and being rewarded for this) & by running a node or delegating to a stake pool.

Note: Staking pools have grown popular on networks like @Cardano & @ethereum, because it lowers the barrier to entry. I.e. users do not have to run their own full node, but can just 'delegate' to another pool & still receive rewards.

Lower barrier to entry = more participation.

Lower barrier to entry = more participation.

1-3 are crucial because they ensure a very high level of cryptoeconomic security.

While 4 also adds to this, I think it's also important because security aside, it allows Chainlink to truly harness the power of its passionate base of supporters/holders & give them upside.

While 4 also adds to this, I think it's also important because security aside, it allows Chainlink to truly harness the power of its passionate base of supporters/holders & give them upside.

Okay so the idea of staking sounds great at a high-level, but how is Chainlink planning to actually implement it?

Well, like previous Chainlink launches, it will be done in an iterative way.

It will start with just the ETH/USD feed in v0.1 and a pool size of 25M $LINK.

Well, like previous Chainlink launches, it will be done in an iterative way.

It will start with just the ETH/USD feed in v0.1 and a pool size of 25M $LINK.

For more details on how the initial community participants will be selected, I'd recommend this thread by @ChainLinkGod below

TL;DR a fair entry mechanism will be used, long-term token holders prioritized, funds locked until V1:

TL;DR a fair entry mechanism will be used, long-term token holders prioritized, funds locked until V1:

https://twitter.com/ChainLinkGod/status/1534309981507534848?s=20&t=d3J9YXGrpXyZ4OOhElP8YQ

Moving into V1 and V2, Chainlink will continue to lean into its network of partners to help drive growth in adoption (and to subsidize rewards) & expand the number of participants.

In parallel, additional facets to staking will be implemented such as slashing and loss protection

In parallel, additional facets to staking will be implemented such as slashing and loss protection

Long term, I'd look for Chainlink to expand staking to cover not only more feeds & services, but also more blockchains.

Chainlink has signaled it believes in a multi-chain future. With the help of CCIP token bridges, they could begin implementing staking beyond just @Ethereum

Chainlink has signaled it believes in a multi-chain future. With the help of CCIP token bridges, they could begin implementing staking beyond just @Ethereum

Today, Chainlink liquidity is represented as an ERC-20 token on Ethereum. With token bridges, Chainlink liquidity could be brought to other chains.

Not only could this be used in DeFi use cases on other chains, but also, to support staking on other chains.

Not only could this be used in DeFi use cases on other chains, but also, to support staking on other chains.

Also, I generally don't talk about price, but it's hard not to imagine staking improving the price of $LINK 📈

From the supply side, we know that it is capped long term at 1B $LINK. However, there hasn't been a strong tokenomics play from the demand side. Staking changes this.

From the supply side, we know that it is capped long term at 1B $LINK. However, there hasn't been a strong tokenomics play from the demand side. Staking changes this.

So to summarize, staking on Chainlink is different than layer-1 blockchains, however it still tries to solve the same issue of cryptoeconomic security.

It's important because it will make its services more secure, increase community participation, and drive demand for $LINK.

It's important because it will make its services more secure, increase community participation, and drive demand for $LINK.

If you enjoyed this thread, consider giving me a follow.

Plus, keep an eye out for my Chainlink deep dive report coming out later this week under my 'Web3 pills 💊' newsletter:

web3pills.substack.com

Plus, keep an eye out for my Chainlink deep dive report coming out later this week under my 'Web3 pills 💊' newsletter:

web3pills.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh