1/ How do real-world assets make their way into DeFi?

Let’s take a look at the recent MakerDAO and Huntingdon Valley Bank (HVB) proposal for a $100 million loan participation facility.

🧵👇

Let’s take a look at the recent MakerDAO and Huntingdon Valley Bank (HVB) proposal for a $100 million loan participation facility.

🧵👇

https://twitter.com/makerdao/status/1543998801786068992

2/ The proposal?

HVB receives a loan participation facility with a 100M $DAI debt ceiling. They’ll use it to support the growth of their existing & new businesses.

In exchange, they’ll post real-world assets as collateral (a portfolio of various loans).

forum.makerdao.com/t/huntingdon-v…

HVB receives a loan participation facility with a 100M $DAI debt ceiling. They’ll use it to support the growth of their existing & new businesses.

In exchange, they’ll post real-world assets as collateral (a portfolio of various loans).

forum.makerdao.com/t/huntingdon-v…

3/ What collateral is eligible? Loans.

- Commercial Real Estate Loans (Stabilized, Construction, Lender Finance)

- Commercial & Industrial Loans

- Government Guaranteed or Affiliated Loans

- Consumer Loans

- Residential Real Estate Loans

- Capital Call Line

- Commercial Real Estate Loans (Stabilized, Construction, Lender Finance)

- Commercial & Industrial Loans

- Government Guaranteed or Affiliated Loans

- Consumer Loans

- Residential Real Estate Loans

- Capital Call Line

4/ But it’s not a loan.

Instead, HVB will have access to DAI liquidity in exchange for the sale of participation interests in the underlying loans originated by HVB.

The $100M will be deployed over 12-18 months. Any idle cash will be invested in 3mo treasuries until deployed.

Instead, HVB will have access to DAI liquidity in exchange for the sale of participation interests in the underlying loans originated by HVB.

The $100M will be deployed over 12-18 months. Any idle cash will be invested in 3mo treasuries until deployed.

5/ What does MakerDAO get?

- YIELD!! Both fixed and floating rate.

- Further integration with traditional markets in a model that can scale to other banks.

- Further diversification of the reserves backing DAI

- YIELD!! Both fixed and floating rate.

- Further integration with traditional markets in a model that can scale to other banks.

- Further diversification of the reserves backing DAI

https://twitter.com/rasterlyrock/status/1541836056181473281

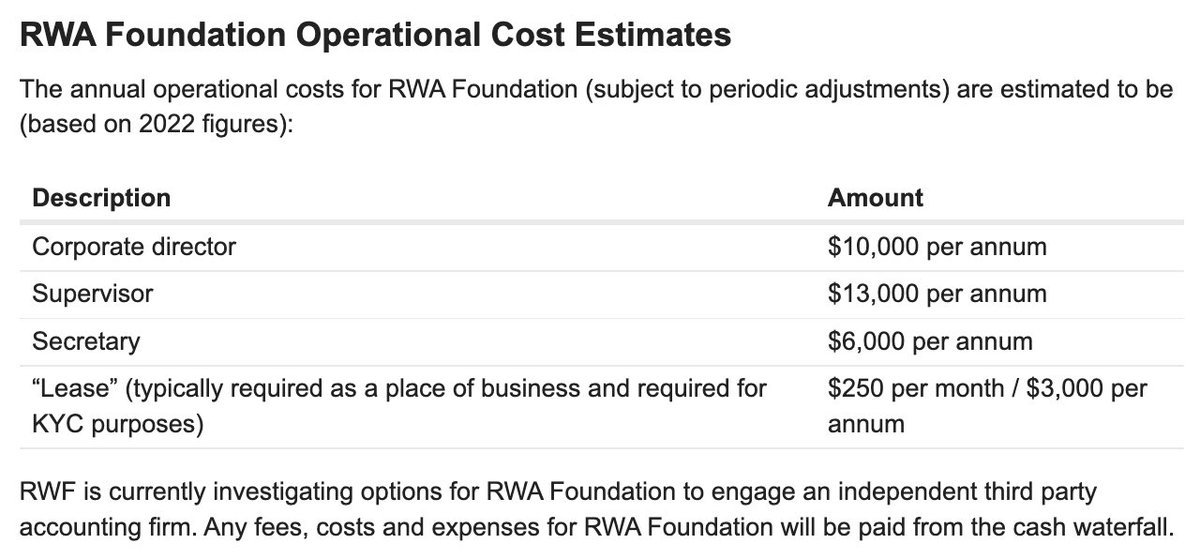

6/ What’s the cost to Maker?

Based on 2022 estimates, the annual operational cost for Maker would be ~$32k.

Any expenses or fees for Maker will be paid from the cash waterfall.

Based on 2022 estimates, the annual operational cost for Maker would be ~$32k.

Any expenses or fees for Maker will be paid from the cash waterfall.

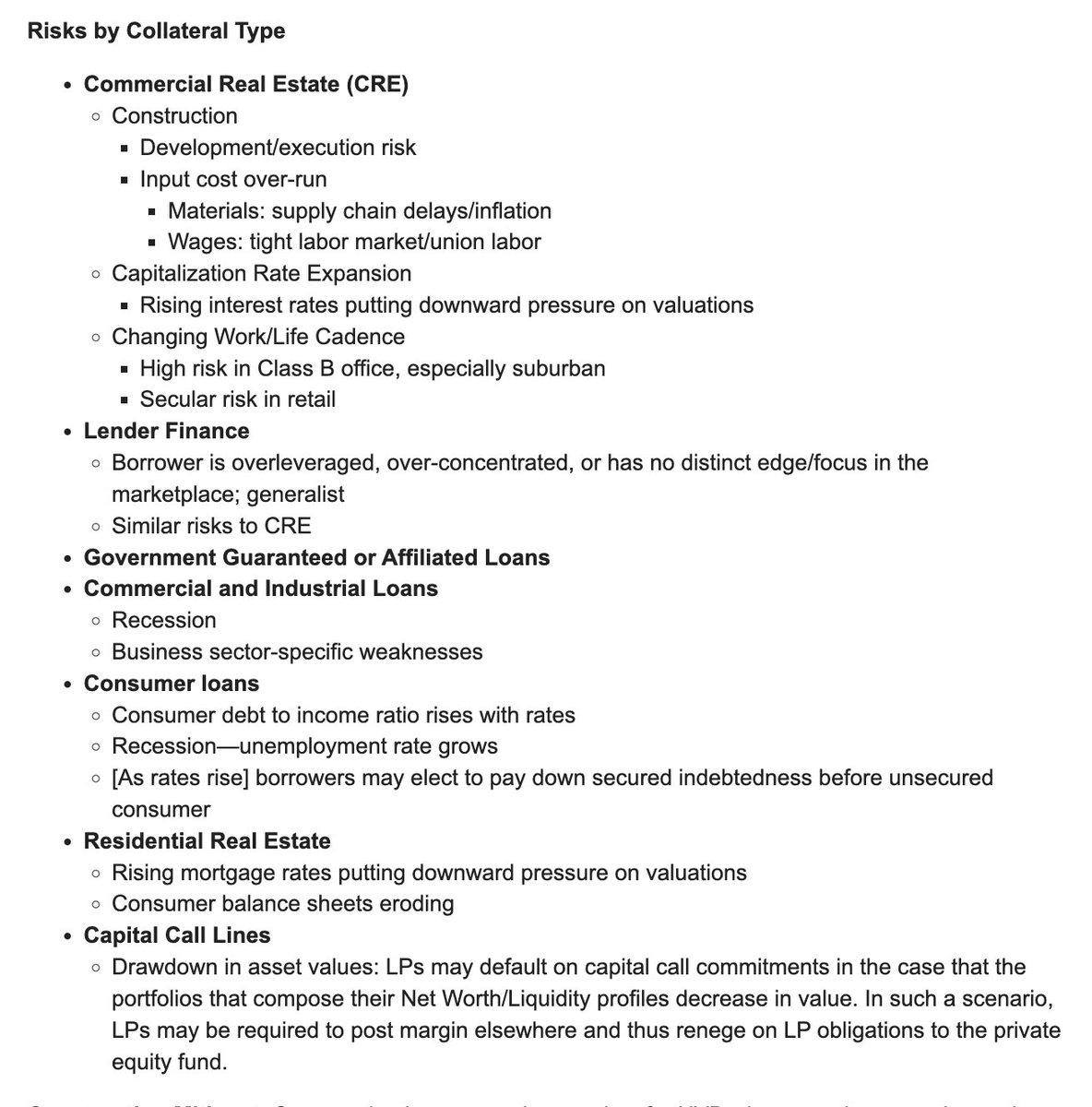

7/ Plus, Maker does take on some risk.

However, HBV retains the right to step in as a limited partner, should default occur.

The unique risks associated w/ these collateral types are outlined in the proposal:

However, HBV retains the right to step in as a limited partner, should default occur.

The unique risks associated w/ these collateral types are outlined in the proposal:

8/ The full proposal and discussion on the @mkrgov forum can be found here.

S/o to @Lempheter, @william_remor, @CCDPetersen, Eric Rapp, and the rest of the @MakerDAO and @MakerGrowth teams for spearheading the initiative 🙌

forum.makerdao.com/t/huntingdon-v…

S/o to @Lempheter, @william_remor, @CCDPetersen, Eric Rapp, and the rest of the @MakerDAO and @MakerGrowth teams for spearheading the initiative 🙌

forum.makerdao.com/t/huntingdon-v…

• • •

Missing some Tweet in this thread? You can try to

force a refresh